The GENIUS Act, introduced with a focus on stablecoins and enacted in July, is anticipated to catalyze significant withdrawal of funds from conventional bank accounts in favor of higher-yielding stablecoin options, according to Tushar Jain, co-founder of Multicoin Capital.

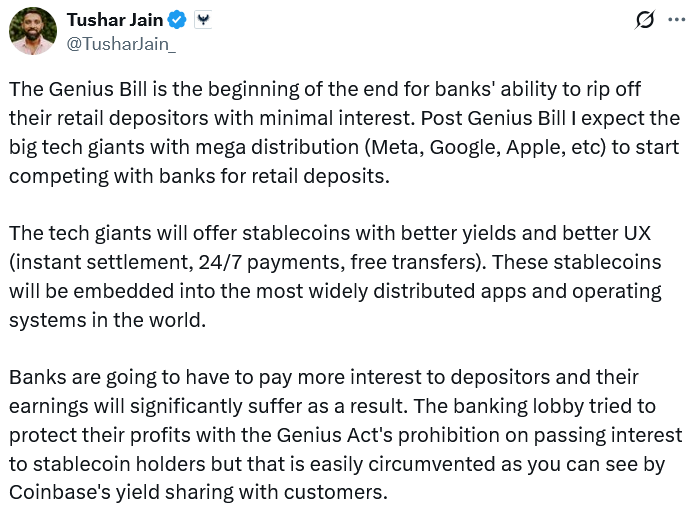

“The GENIUS Bill signifies the dawn of a new era where banks can no longer exploit their retail clients with minimal interest rates,” Jain stated in a post on X on Saturday.

He elaborated that, “Following the enactment of the GENIUS Bill, I foresee major tech corporations with vast reach—such as Meta, Google, and Apple—entering the competition for retail deposits, likely providing superior stablecoin yields along with an enhanced user experience featuring instant settlements and around-the-clock payments, which traditional banks struggle to match.”

Jain also pointed out that banking associations made efforts in mid-August to “shield their profits” by asking regulators to close a loophole that might let stablecoin issuers offer interest or yields via their affiliates.

The GENIUS Act explicitly prohibits stablecoin issuers from providing interest or yields to token holders, but it does not directly prohibit crypto exchanges or their affiliates, which may allow these issuers to circumvent the law by leveraging those partnerships to offer yields.

Concerns are arising among US banking groups regarding the potential widespread adoption of yield-bearing stablecoins, which they believe could destabilize the traditional financial system that depends on attracting deposits to facilitate lending.

Potential $6.6 trillion exodus from banks

The mass adoption of stablecoins could lead to an outflow of approximately $6.6 trillion from the conventional banking sector, as estimated by the US Department of the Treasury in April.

The Bank Policy Institute warned in August that, “This would result in heightened risks of deposit flight, particularly during periods of financial stress, ultimately compromising credit creation in the broader economy. Such a decrease in the credit supply would drive up interest rates, limit loan availability, and raise costs for small businesses and households.”

To remain competitive, Jain remarked, “banks will be compelled to offer higher interest rates to depositors, which will adversely affect their profitability.”

Stablecoins present up to 10 times greater interest

Currently, the average interest rate for savings accounts in the US is around 0.40%, while the European average stands at 0.25%, as noted last week by Patrick Collison, CEO of online payments platform Stripe.

In contrast, interest rates for Tether (USDT) and Circle’s USDC (USDC) on the lending and borrowing platform Aave currently stand at 4.02% and 3.69%, respectively.

Big Tech is rumored to be investigating stablecoins

Jain’s projections regarding tech giants follows a report from Fortune in June indicating that companies like Apple, Google, Airbnb, and X are among those considering the issuance of stablecoins to reduce transaction fees and enhance cross-border payment efforts. There have been no additional updates since that report.

Related: All currencies will transition to stablecoins by 2030: Tether co-founder

The current value of the stablecoin market is estimated at $308.3 billion, dominated by USDT and USDC, which hold values of $177 billion and $75.2 billion, respectively, according to CoinGecko data.

The Treasury Department predicts that the market capitalization for stablecoins could surge by another 566%, reaching $2 trillion by 2028.

Magazine:Crypto once aimed to disrupt banks, now is becoming them in the stablecoin struggle