The recently enacted GENIUS Act, which focuses on stablecoins, may lead to a significant shift of deposits from traditional bank accounts into more lucrative stablecoin options, as suggested by Tushar Jain, co-founder of Multicoin Capital.

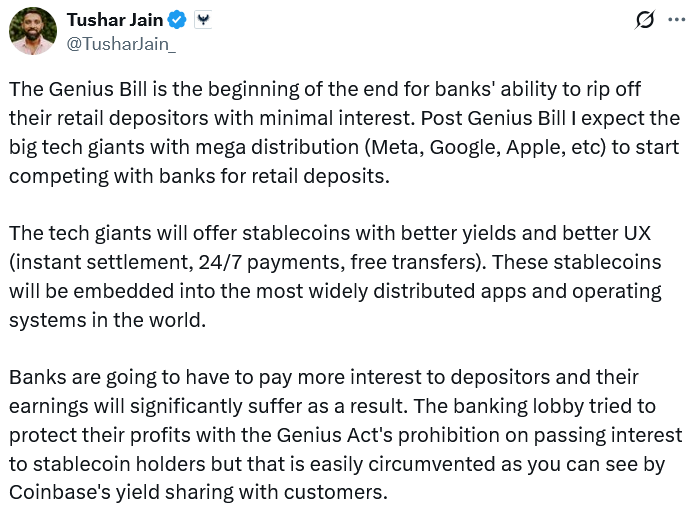

“The GENIUS Bill marks the beginning of the end for banks’ ability to unfairly benefit from retail depositors with meager interest rates,” Jain remarked in a post on X on Saturday, outlining the bill’s implications.

He further predicts that following the GENIUS Act, major technology companies like Meta, Google, and Apple will begin to compete with banks for retail deposits, championing better yields on stablecoins along with a superior user experience that includes instant settlements and round-the-clock payments, unlike traditional banking institutions.

Additionally, Jain pointed out that banking organizations attempted to maintain their profit margins in mid-August by urging regulatory bodies to close a perceived loophole, which might allow stablecoin issuers to provide interest or yields to token holders via their affiliates.

The GENIUS Act expressly forbids stablecoin issuers from providing interest or yields to token holders, yet does not clearly extend this prohibition to crypto exchanges or their affiliated companies, potentially allowing issuers to circumvent the law by offering yields via these partners.

Concerns arise among US banking groups that the widespread acceptance of yield-bearing stablecoins could destabilize the traditional banking system, which fundamentally relies on banks attracting deposits to support lending operations.

$6.6 trillion could exit the banking sector

According to estimates from the US Department of the Treasury in April, widespread stablecoin adoption could lead to about $6.6 trillion in deposit withdrawals from traditional banking institutions.

The Bank Policy Institute warned in August that “the outcome will be an increased risk of deposit flight, particularly during economic pressures, which will undermine credit creation across the economy. This corresponding decline in credit availability could lead to higher interest rates, a reduction in loans, and increased expenditures for Main Street businesses and households.”

To remain viable, Jain asserts, “banks will have to increase the interest they offer to depositors,” warning that “their profitability will take a substantial hit as a result.”

Stablecoins present users with significantly higher interest rates

The average interest rate for savings accounts in the US is currently at 0.40%, while in Europe, the average hovers around 0.25%, as highlighted by Stripe’s CEO Patrick Collison last week.

In contrast, the borrowing and lending platform Aave reports current rates for Tether (USDT) and Circle’s USDC (USDC) at 4.02% and 3.69%, respectively.

Big Tech companies are reportedly looking into stablecoins

Mistaking on Jain’s bets regarding major tech firms follows a Fortune article from June indicating that companies such as Apple, Google, Airbnb, and X are among those considering issuing stablecoins to reduce transaction fees and enhance cross-border payment efficiency. However, there have been no updates since then.

Related: All currencies will be stablecoins by 2030: Tether co-founder

The current stablecoin market is valued at $308.3 billion, with USDT and USDC dominating the space at $177 billion and $75.2 billion, respectively, according to data from CoinGecko reported.

Furthermore, the Treasury Department anticipates that the stablecoin market cap will surge an additional 566% to reach $2 trillion by 2028.