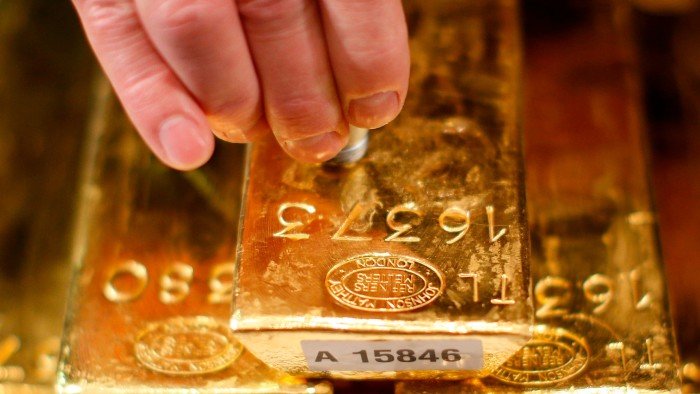

Germany and Italy are facing increasing pressure to repatriate their gold reserves from New York amid concerns about President Donald Trump’s attacks on the US Federal Reserve and rising geopolitical tensions. Both countries hold significant amounts of gold in the US, with Germany storing 3,352 tonnes and Italy storing 2,452 tonnes in New York. The total market value of the gold stored in the US by these two countries is estimated to be over $245 billion.

The idea of moving gold reserves back to Europe or to their respective countries is gaining traction, with politicians and experts expressing concerns about the security and stability of keeping the gold in the US. Fabio De Masi, a former MEP from Germany, highlighted the need to consider relocating gold to Europe during turbulent times. Peter Gauweiler, a former conservative MP from Bavaria, emphasized the importance of safeguarding Germany’s gold reserves and raised questions about the security of storing gold abroad.

The Taxpayers Association of Europe has urged policymakers in Germany and Italy to reconsider their reliance on the Federal Reserve as a custodian for their gold reserves. The association expressed concerns about Trump’s interference with the independence of the Federal Reserve and recommended bringing the gold back home to ensure greater control over it.

In Italy, economic commentator Enrico Grazzini warned about the risks of leaving a significant portion of the country’s gold reserves in the US under the current administration. A survey of global central banks revealed that more banks are considering storing their gold domestically due to concerns about accessing their reserves in times of crisis.

The history of European countries storing gold in the US dates back to the post-World War II era, when large trade surpluses with the US led to the accumulation of significant gold reserves. However, recent geopolitical uncertainties and Trump’s unpredictable policymaking have prompted a reevaluation of this practice.

In Germany, a grassroots campaign led to the repatriation of half of the country’s gold reserves from Paris and New York to Frankfurt in 2013. The move was seen as a step towards ensuring greater control and security over the gold reserves. Similarly, in Italy, there have been calls for repatriating the country’s gold reserves, but the current government has remained silent on the issue.

Overall, the debate surrounding the repatriation of gold reserves highlights the growing concerns about geopolitical risks and the need for central banks to have full control over their assets in uncertain times. The calls for moving gold out of New York underscore the importance of safeguarding national assets and ensuring financial security in the face of global challenges.

Fabio Rampelli, a parliament member of the Brothers of Italy party, recently expressed the party’s current stance on Italy’s gold reserves. He stated that the “geographical location” of Italy’s gold was of only “relative importance” as it is currently in the custody of “a historic friend and ally”.

This statement by Rampelli sparked a discussion on the significance of where a country’s gold reserves are stored. German investment veteran Bert Flossbach, co-founder of Flossbach von Storch, Germany’s largest independent asset manager, echoed similar sentiments. Flossbach argued that repatriating gold reserves with great fanfare could potentially signal deteriorating relations with the United States.

The Bundesbank, Germany’s central bank, emphasized that it regularly evaluates the storage locations for its gold holdings based on guidelines established in 2013. These guidelines prioritize not only security but also liquidity to ensure that gold can be easily sold or exchanged into foreign currencies if necessary. The Bundesbank affirmed that the New York Federal Reserve remains an important storage site for German gold, emphasizing their trust in the Federal Reserve’s reliability for safekeeping their gold reserves.

Despite these statements, the Bank of Italy, as well as the offices of Giorgia Meloni and the finance ministry in Berlin, declined to provide any comments on the matter.

In conclusion, the debate surrounding the geographical location of a country’s gold reserves continues to be a topic of interest among policymakers and financial experts. The decision on where to store gold reserves is not only based on security considerations but also on diplomatic relations and liquidity needs. The reassurance of trust in the custodian of these reserves is crucial in maintaining stability in the global financial system.