The Impact of High Tariffs on the US Economy

Over a long period of time, the US economy has been shifting away from goods and toward services. If the US switches to a high tariff policy, this would accelerate the shift to services. To see why, we need to review some basic concepts in trade theory.

To illustrate some of the ideas, I’d like to consider a 20% tax on all imported goods. By assumption, services are exempt. Let’s begin by considering the example of imported oil. For simplicity, we’ll assume the US imports most of its oil (an assumption that is no longer valid.)

If the global price of oil were $80/barrel, then a 20% tax would tend to raise the price by $16. However, the price would probably rise by slightly less than $16, because the tariff would encourage domestic production and discourage domestic consumption. Thus $16 would be the upper limit of the resulting price increase. That’s equivalent to about 40 cents a gallon. I suspect the actual increase would be slightly smaller, let’s say about 37 cents, which is roughly double the 18.4 cent federal tax on gasoline.

Today, the US is a major oil producer. We still import lots of oil, but we also export a significant amount. In that case, the net effect of the tariff is more complex. Some oil that is currently being exported might be diverted to domestic consumption in parts of the US that are currently importing oil. In that case, the major effect might be higher transport costs, as oil gets re-routed.

Most economists assume that tariffs are paid by consumers in the domestic economy. In principle, part of the burden might be borne by foreign exporters if the tariff had the effect of depressing the global price of the good being imported. On the other hand, if other countries retaliate with their own tariffs (which seems plausible), then it again makes sense to assume that almost all the tariff is borne by domestic consumers. In my view, that is the most reasonable assumption.

So is a 20% tariff like a 20% VAT? Not quite, because the VAT applies to both goods and services, while a tariff applies only to goods.

Does a tariff improve the current account balance? Probably not, as the current account balance is domestic saving minus domestic investment. In most cases, it would only increase the current account balance if it boosted domestic saving, which would only occur if the tariff revenue were used for deficit reduction. And even in that unlikely case, the effect would be rather small. The main effect of tariffs is to reduce all trade in goods, both imports and exports. With a high tariff policy, both our imports and our exports would become smaller. Most importantly, the goods sector of the economy would be taxed at a much higher rate than the service sector, which would reduce goods as a share of GDP.

This may seem counterintuitive, as we tend to think of tariffs leading to more production of goods that were formerly being imported. And they do. But the negative effects on goods production are even greater. This is because the positive effect to domestic production from fewer imports is offset by the negative effect from fewer exports. But tariffs also tilt consumption away from goods and toward services. It’s this extra effect (beyond the trade balance) that results in the economy shifting from goods to services production.

Would a 20% tariff increase inflation? That depends on the response of the Fed. It’s likely that the Fed would allow a one-time price increase, on the grounds that the effect of tariffs is “transitory”. If the Fed wished to avoid higher prices, they would be forced to have a tight money policy that reduced nominal wages. Either way, tariffs tend to reduce after-tax real wages unless offset with tax cuts elsewhere.

A high tariff on imported oil would discourage the consumption of oil, which is something that many environmentalists favor. I’ll leave it to the reader to determine whether this is the goal of most advocates of a high tariff policy.

PS. Obviously the world is complex, and you can make assumptions that yield different results. But I suspect that many people don’t understand that the first-order effects predicted by standard trade models are that tariffs will boost services production and reduce goods production.

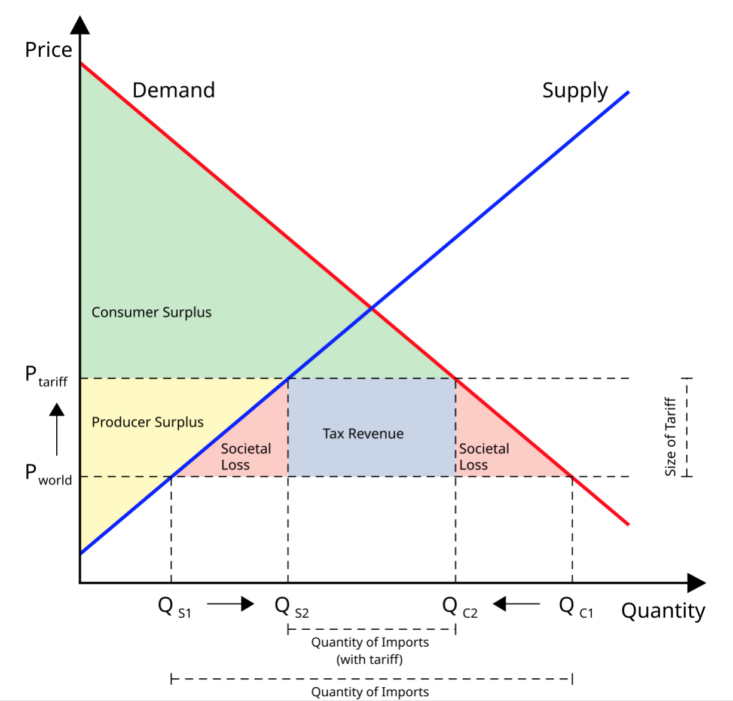

Here’s the simple trade graph in the special case where the importing country has no effect on the global price: