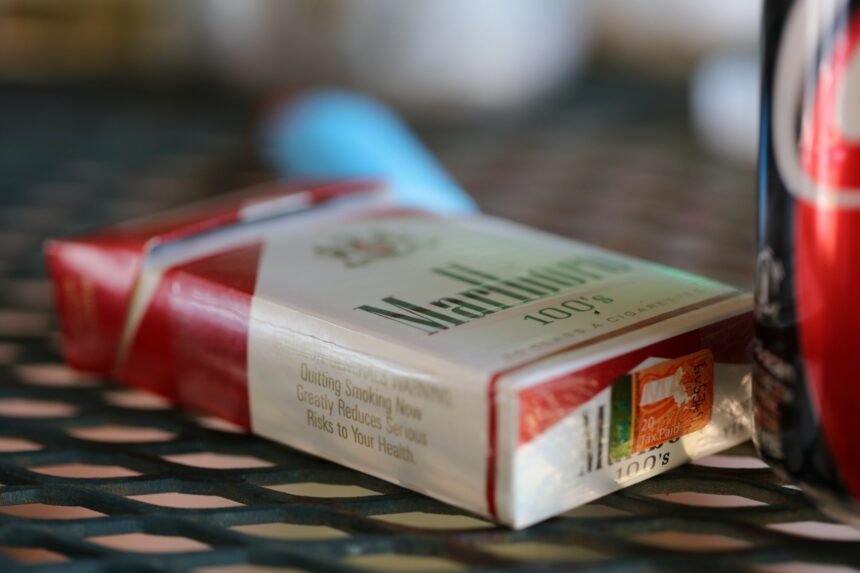

A recent study led by researchers at Karolinska Institutet suggests that implementing higher taxes on cigarettes in low and middle-income countries (LMICs) could significantly reduce child mortality rates, particularly among the most vulnerable children. The study, titled “Cigarette taxation and socioeconomic inequalities in under-five mortality across 94 low- and middle-income countries,” was published in The Lancet Public Health.

The World Health Organization (WHO) recommends a minimum tax of 75% on the retail price of cigarettes to discourage smoking. However, most countries fall short of this recommendation, resulting in higher rates of smoking-related illnesses and deaths among children.

Lead researcher Márta Radó emphasizes that if all 94 countries included in the study had adhered to the WHO’s tax recommendation, over 280,000 children’s lives could have been saved in just one year. Additionally, implementing higher cigarette taxes could help bridge the gap in child mortality rates between different socioeconomic groups, aligning with the UN’s sustainable development goals.

The study analyzed publicly available data from organizations such as the WHO, the World Bank, and the UN Inter-agency Group for Child Mortality Estimation (UN IGME) from 2008 to 2020. The researchers examined the correlation between child mortality rates and various types of cigarette taxes, including excise duties, ad valorem duties, import duties, and VAT. They found that excise duties had the most significant impact on improving childhood survival rates and reducing disparities between rich and poor populations.

Olivia Bannon, the lead author of the study, underscores the importance of implementing higher cigarette taxes as a crucial policy measure to enhance children’s health globally, particularly among the most vulnerable groups in LMICs.

Despite the benefits of higher cigarette taxes, the tobacco industry often employs tactics to impede or delay the implementation of effective tobacco control measures. Dr. Radó urges governments to overcome these obstacles and prioritize the health and well-being of children by enforcing higher taxes on tobacco products in LMICs.

The study was conducted in collaboration with researchers from Erasmus MC (the Netherlands), McGill University (Canada), and Imperial College London (UK). For more information, the study titled “Cigarette taxation and socioeconomic inequalities in under-five mortality across 94 low- and middle-income countries” can be accessed in The Lancet Public Health.

This groundbreaking research highlights the potential life-saving impact of increasing cigarette taxes in LMICs and emphasizes the importance of prioritizing public health initiatives to protect children from the harmful effects of smoking.