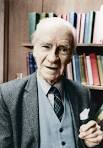

George Kinder, the father of the “life planning” branch of financial advice, is on a mission to help everyone achieve personal freedom. His new book, “The Three Domains of Freedom,” delves into the interconnection of finance and personal fulfillment. Kinder, who founded the Kinder Institute of Life Planning in 2003, believes that financial planning is ultimately about delivering individuals into a state of freedom.

In an interview, Kinder discussed his belief that every person has a dream of freedom, regardless of their financial situation. The focus of life planning shifts from the anxiety-inducing tasks of managing money to the pursuit of personal freedom. By helping clients uncover their life goals through exercises like his famous “three questions,” Kinder believes that financial problems can be solved more easily.

Kinder emphasized that people often get caught up in the daily grind of saving money without a clear understanding of what they are saving for. He believes that by identifying one’s dream of freedom, financial tasks become more manageable and purposeful. Kinder highlighted the importance of keeping one’s eyes on the prize and aligning financial decisions with personal goals and ambitions.

When it comes to saving for retirement, Kinder challenges the conventional wisdom of saving a specific percentage of income. He encourages individuals to question why they are saving and to consider how they can achieve personal freedom in the short term. By reframing retirement savings as a means to attain freedom, Kinder believes that individuals can experience a greater sense of fulfillment and autonomy in their lives.

Ultimately, Kinder’s message is clear: don’t wait until retirement to pursue your dreams. By aligning financial decisions with personal aspirations and focusing on the goal of freedom, individuals can lead more purposeful and fulfilling lives. Kinder’s life planning philosophy offers a fresh perspective on financial advice, emphasizing the importance of personal fulfillment and empowerment. Financial planning is not just about saving money for retirement; it’s about creating a life of freedom and fulfillment. George Kinder, founder of the Kinder Institute of Life Planning, believes that everyone, regardless of their financial means, can achieve this freedom.

Kinder, who grew up in a poor part of the country, understands that the desire for freedom is universal. In his new book, “The Three Domains of Freedom,” he emphasizes the importance of living a life that aligns with your passions and values. The book encourages readers to create their own life plan and seek out a fiduciary to help them achieve their goals.

One of Kinder’s key insights is that true freedom can only be experienced in the present moment. By practicing mindfulness and being fully present, individuals can make better financial decisions and live a more peaceful life. Kinder also advocates for institutions and organizations to act as fiduciaries, prioritizing the well-being of society and the planet over their own self-interest.

In a world where the concept of “retirement” is outdated, Kinder urges people to shift their focus to achieving true freedom in every aspect of their lives. By redefining our relationship with money and prioritizing our values, we can create a future that is not only financially secure but also personally fulfilling.

As you embark on your own journey towards financial freedom, remember that it is not just about reaching a certain savings goal. It’s about living a life that is meaningful and aligned with your true desires. With the right mindset and a commitment to your values, you can create a future filled with freedom and fulfillment.