Becoming a certified public accountant (CPA) is a popular career choice for many individuals, especially for those who have a passion for numbers and financial management. The field of accounting offers a wide range of job opportunities and is constantly growing, making it an attractive option for those seeking a stable and rewarding career. If you’re considering a career as a CPA, it’s essential to understand the steps involved in becoming certified, as well as the skills and qualifications required for success in the field.

What is a CPA?

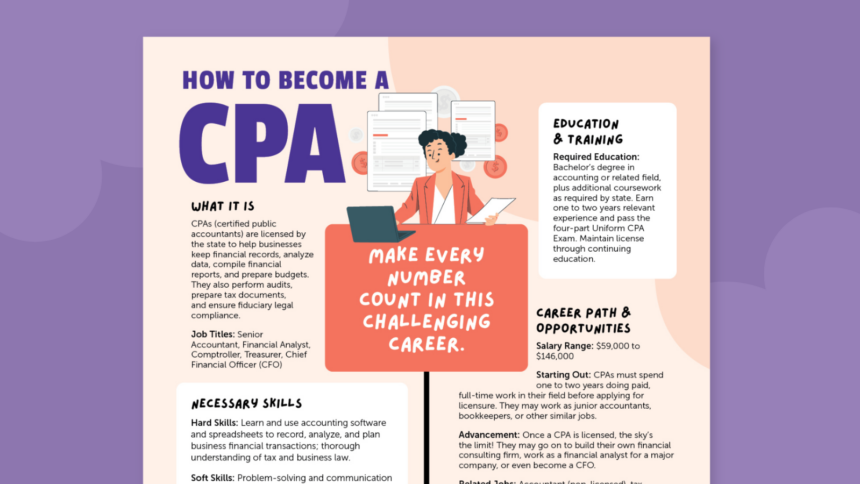

A CPA, or certified public accountant, is a professional who works with businesses to manage their financial transactions, analyze data, compile financial reports, create budgets, perform audits, prepare tax documents, and ensure legal compliance. Unlike regular accountants, CPAs are licensed by the state after completing specific education requirements and passing licensing exams. This certification demonstrates that a CPA is fully qualified to handle all essential accounting tasks and must complete continuing education to maintain their license.

Why become a CPA?

The field of accounting offers limitless potential for growth and job stability. CPAs are in high demand across various industries, including public accounting, corporate finance, government, and non-profit organizations. The average salary for a CPA in the United States is around $93,000 per year, significantly higher than non-certified accountants. Additionally, CPAs are trusted advisors and carry a level of prestige in the business world.

What do CPAs do on a daily basis?

The daily tasks of a CPA can vary significantly, from closing financial records to meeting with clients and colleagues. Problem-solving is a crucial aspect of the job, as CPAs use numbers to interpret data and make strategic decisions for businesses. Effective communication, time management, and teamwork skills are essential for success in the field.

What are the necessary skills for CPAs?

In addition to strong math and accounting skills, successful CPAs must possess a wide range of skills, including problem-solving, communication, and the ability to tell a compelling story with data. Embracing technology is also crucial, as CPAs are at the forefront of digital transformation in the accounting profession.

Do CPAs need a degree?

Yes, most CPAs earn a bachelor’s degree in accounting or a related field. Each state has specific requirements for the number and type of courses needed to become a CPA. Additionally, most states require a minimum of 150 hours of college coursework, so additional courses may be necessary to meet this requirement.

The process of becoming a CPA involves earning a bachelor’s degree, passing the Uniform CPA Exam, gaining relevant work experience, and completing continuing education requirements. It’s important to check with your state’s licensing board for the most accurate and up-to-date information on becoming a CPA.

In conclusion, becoming a CPA is a rewarding and challenging career choice with many opportunities for growth and advancement. By following the steps outlined above and honing the necessary skills, you can embark on a successful career as a certified public accountant.