Georgia has become a shining example of the benefits of the Inflation Reduction Act (IRA) under President Joe Biden’s administration. The state has seen a surge in new clean energy jobs, with a projected 42,000 new jobs set to be created as a result of American clean energy projects announced since the passage of the law in August 2022. These jobs, spread across various industries, are a testament to the IRA’s commitment to reindustrializing America through climate action.

However, the future of these jobs is now uncertain as congressional Republicans are considering repealing some or all of the IRA’s tax credits to fund President Donald Trump’s proposed tax cuts. This move has already had repercussions, with two battery manufacturers canceling plans for new factories in Georgia, jeopardizing 1,400 potential jobs and nearly $3 billion in investment.

Ironically, the IRA, which was passed through reconciliation as a Democrat-only bill, disproportionately benefits Republican-held districts. In Georgia, 80% of the projects, 94% of the total investment, and 75% of the jobs are located in Republican districts. This has led to a divide within the Republican party, with some members advocating for the preservation of key IRA tax credits.

The future of the IRA hangs in the balance as Republicans navigate the passage of Trump’s proposed budget reconciliation bill, which requires at least $1.5 trillion in savings to offset new spending. The disagreement within Republican ranks has led to a series of letters from Congresspeople lobbying for the preservation of various IRA tax credits, highlighting the critical importance of these incentives in driving clean energy investments.

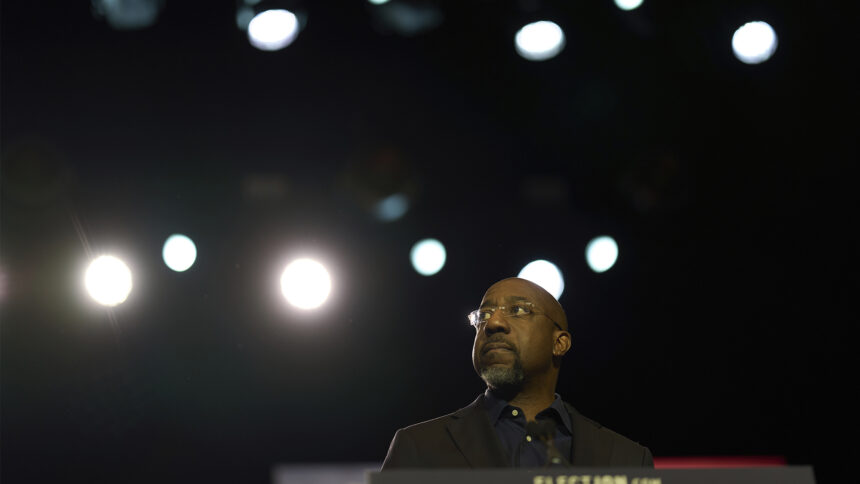

Senator Raphael Warnock of Georgia has been vocal in defending the IRA, arguing that repealing the bill would be a “job killer” and a misguided attempt to prioritize tax cuts for billionaires over job creation. Warnock’s report reveals that post-IRA business investment in clean energy manufacturing in Georgia has skyrocketed, totaling nearly $16.4 billion, marking a significant increase from previous years.

Despite the challenges and uncertainties, Georgia remains at the forefront of the clean energy revolution, with thousands of jobs and billions of dollars in investments at stake. The future of the IRA and its impact on Georgia’s economy will be a critical issue to watch as lawmakers debate the fate of these crucial tax credits. Georgia made headlines in December 2021 and May 2022 with the announcements of two massive economic development projects that were set to bring thousands of new jobs to the state. The first announcement came from Rivian, a leading electric car manufacturer, which revealed plans to invest $5 billion in building a new electric car plant in Georgia. The second announcement came from Hyundai, which announced a $5.5 billion investment in a new EV and battery plant in the state. Together, these two projects were expected to create a total of 15,600 new jobs in Georgia.

However, these announcements also sparked political debate, especially in the lead-up to the Infrastructure Investment and Jobs Act (IRA). Democrats in Georgia were eager to claim credit for the state’s job growth, while Republican Governor Brian Kemp touted his use of tax breaks to attract these major investments. Kemp argued that the IRA would hurt Georgia more than it would help, despite the economic benefits brought by the Rivian and Hyundai plants.

A report released by Senator Warnock highlighted the job growth in Georgia but failed to mention the impact of the Rivian investment on the state’s economy. When questioned about the figures, a spokesperson for Warnock stated that Rivian was not included in the total investment amount, leaving some uncertainty about the numbers presented in the report.

The debate over the IRA extends beyond just the economic impact on manufacturers and employees. The law also includes provisions that benefit communities, homeowners, and small organizations. From subsidies for low-income citizens to invest in rooftop solar to rebates for home energy improvements, the IRA has a direct impact on ordinary people’s lives.

While the focus may be on the flashy billion-dollar factories brought in by the IRA, it is important to recognize the broader impact of the law on the community. Programs that support clean energy transition and provide financial assistance to those in need are crucial components of the IRA that should not be overlooked.

As Georgia navigates the implications of the IRA and debates its future, it is essential to consider the full spectrum of its effects on both the economy and the everyday lives of its residents. The balance between economic growth and community support will play a vital role in shaping the state’s future.