Physician Confusion: Navigating the Complexities of Health Insurance Costs

Imagine your physician prescribed an expensive new drug for you, hopeful it will control a serious chronic illness. Concerned about its price, you ask what your out-of-pocket costs will be. To help your physician, you even pull out details of your insurance coverage.

But even with this information in mind, don’t expect your physician to be able to estimate your costs. The complexity of American health insurance coverage has many physicians bamboozled.

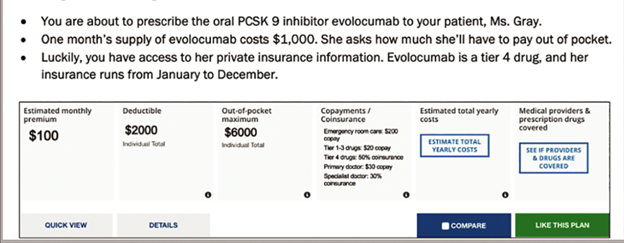

A few years ago, I participated in a study led by Caroline Sloan, a physician at Duke University. We surveyed a national sample of American physicians and asked them to imagine they were prescribing a $1000 per month drug to one of their patients who inquired about their out-of-pocket costs. We gave physicians the following information:

The patient’s insurance plan

And we asked them to provide four cost estimates:

The quiz questions

Can you figure out the correct answer to these four questions?

Here they are:

- In January, the patient will pay the full cost of the drug, $1000, because she has not yet paid off her $2000 deductible.

- In March, the patient will pay $500, based on the 50% coinsurance rate for the drug.

- Those tier 1 drugs will each cost $20, for a total of $60 per month.

- By December, the patient will have met her $6000 annual out-of-pocket maximum, meaning the medication will be free. But watch out for next January!

Hopefully, a lot of you got a lot of these questions correct. Unfortunately, only one in five physicians gave us correct answers to all four questions. Meanwhile, a similar number got none of the right answers.

Number of correct answers

It is hard to blame physicians for being confused. Medical schools rarely teach students about deductibles, coinsurance, or out-of-pocket maximums.

But here’s the good news. Today, many physicians have access to electronic tools, embedded in the medical record, that estimate patients’ out-of-pocket medication costs based on up-to-the-minute details of their insurance coverage, whether they paid off their deductibles, and whether they have reached their annual out-of-pocket maximum.

If you have questions about the cost of your medications, ask your whether they have access to this information through their computer. If they do, you might be able to save yourself a lot of money.