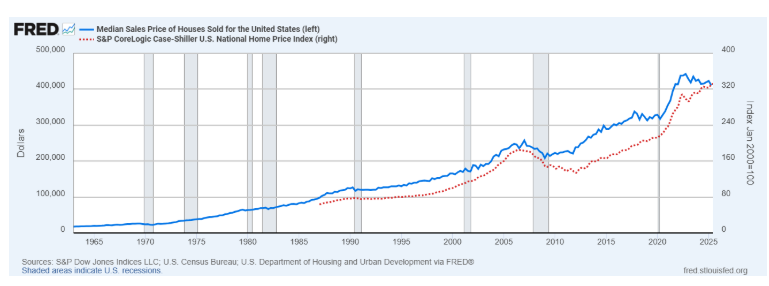

Current average home prices are hovering near the peak levels seen at the start of the year. As a result, public sentiment surveys indicate increasing worries about housing affordability, prompting politicians to take action. The Trump administration is considering a potential national housing emergency declaration, which would empower the President to take certain measures. We may need to wait for an official decree to fully grasp Mr. Trump’s perspective on his emergency powers related to housing policy.

However, the question remains: are houses truly more expensive in the long term, or is this simply an illusion? As an economist with expertise in residential construction, this is a topic I ponder frequently.

Upon reading various articles about the housing affordability dilemma, I generally align with the consensus among economists that America faces a foundational housing supply issue. Regulatory barriers—including zoning laws, permitting processes, energy-efficiency standards, and occupational licensing—inflate construction costs. Additionally, tariffs and the removal of illegal immigrant labor contribute to the problem. I firmly support the perspective that easing regulations could significantly enhance housing affordability.

Conversely, I perceive that much of the concern surrounding ever-increasing home prices stems from an incomplete analysis. Such discussions often overlook critical factors necessary for a comprehensive understanding of the data trends. Rigorous economic analysis must consider other variables—applying the well-known ceteris paribus assumption. In evaluating home prices, it’s essential to take into account a range of other variables. Through basic calculations using readily available data, I argue that home prices are not excessively above their long-run averages.

Key Factors in Housing Analysis

So, what are the ceteris we ought to hold paribus when scrutinizing long-term trends in US home prices? Let’s begin with the prominent factor: inflation. We cannot directly compare nominal home prices from 2019 to 2025 (with CPI increasing by 26% over these six years), let alone from earlier periods such as 1990 or 1960, which are often deemed benchmarks for affordability.

Let’s use 1960 (the earliest year for which I can gather data for all my ceteris paribus categories) as a benchmark for home affordability in the US. Between 1960 and 2024, the nominal median home price increased by 3,421%, but once adjusted for inflation using the Consumer Price Index, the rise appears more moderate, at about 232%. However, when we also take into account the slower growth rate of household incomes during this period, we find that the home price to household income ratio—calculated by dividing the median home price by the median household income—rose from roughly 2.1 to around 5.2, reflecting a 145% increase over the same timeframe.

Next, it’s important to examine what individuals are actually obtaining with their purchase of the median home. In 1960, the average median home was 1,500 square feet. Home sizes grew steadily, peaking at approximately 2,700 square feet in the mid-2010s before slightly retracting to 2,400 square feet by 2024. Assuming larger homes are preferable and that buyers are willing to pay more for additional space, we can adjust our analysis by calculating the real home price per square foot of home size. This measure surged by 107% from 1960 to 2024, a significant increase, yet considerably more manageable than the raw real median price alone or when simply adjusted for household incomes.

As we continue, I want to ensure our examination is thorough. An essential analytical insight I gained from the renowned Thomas Sowell is to be cautious of composition effects, where shifts in the characteristics of groups over time can distort overly simplistic statistical views. Sowell emphasizes being vigilant for these effects in household statistics, as average household sizes can dramatically change. In 1960, the average US household had 3.33 individuals; this number dwindled to about 2.5 by the 2020s, predominantly before the 1990s.

This decrease implies that median household income is divided among fewer individuals, leading to an understatement of the real gains in individual income over time. Thus, real median household income per person has risen significantly more than reported in aggregate household income statistics. We can integrate this into our home price assessment by computing the ratio of real home price to real household income per person. This adjusted figure increased by 96% from 1960 to 2024.

Finally, let’s merge the changes in home size with the changes in household composition from the previous calculation. Our ultimate metric, the ratio of real home price per square foot to real household income per person, reveals a rather unremarkable picture: housing affordability improved by just 6% from 1960 to 2024, and has seen a notable decline from its peak in the late 1970s.

Additionally, it’s crucial to note that all these adjustments fail to consider potentially the most significant shift: the enhancement of home quality in relation to features and amenities that have become standard over the years. Identifying an index of home quality that reliably tracks these attributes has proven to be challenging. However, my observations—combined with various data snippets—lead me to the conclusion that modern homes provide a far superior living experience compared to those built three or six decades ago. According to a US Census report from 2011, modern homes boast larger sizes and more amenities, including additional bedrooms and bathrooms, various conveniences like washers and dryers, safety features such as smoke and carbon monoxide detectors, and more. Today’s rooms are not only more spacious but also feature enhanced energy efficiency, user-friendly appliances, added garage space, larger kitchens with upgraded countertops, and more. If we could somehow factor all these improvements into the comprehensive home price adjustments, the analysis might even suggest that home prices have either stagnated or decreased, ceteris paribus.

To conclude, the notion of a housing affordability crisis seems exaggerated!

While it’s crucial to analyze changes within the ceteris, I want to stress that there is indeed a housing price issue that merits thoughtful public policy attention. I hope my “comprehensive” analysis of real home price adjustments provides insight, but this review has its limitations in at least two key areas: 1. It selectively chooses the starting and ending points; 2. It relies on national aggregate data, which may overlook regional fluctuations in home price movements.

When examining intervals of ten years, there is significant variability in home price trends, even using my preferred ratio of real home price per square foot to real household income per person metric. Home prices in 2024 were 22% higher than those a decade earlier, offering grounds for younger generations to assert that home prices are increasingly inaccessible. Furthermore, the recent surge in housing prices underscores the reality that housing markets often act as a mechanism for wealth transfer from financially struggling millennials to affluent boomers. Furthermore, housing price growth differs significantly by region; areas experiencing a surge, primarily coastal and sunny metropolitan locations, have seen ten-year price increases 1.5 to 2 times the national average, while less active markets in certain southern and Midwestern areas have seen growth rates barely exceeding the overall inflation rate.

According to an insightful map from Visual Capitalist, it is far more feasible to purchase a house (ceteris paribus, of course!) in the Midwest compared to the West, Northeast, or Florida. (I suspected there had to be a compensating factor for the harsh winters in Michigan!)

Addressing the escalation of home prices requires straightforward, though politically challenging, solutions. We must work to mitigate the growth in construction costs relative to home supply. In simple terms, we need the housing supply curve to “shift to the right” at a faster rate than the corresponding demand curve. Builders are acutely aware of the steps necessary for this: reducing zoning restrictions (especially for multifamily properties), streamlining licensing and permitting procedures, relaxing building codes and energy standards, enhancing market freedom in labor and materials, and perhaps even encouraging consumer acceptance of smaller, simpler homes.

Dataset and calculations available upon request: tylerwatts53@gmail.com

Tyler Watts is a professor of economics at Ferris State University.