Labcorp Holdings Inc.: A Leading Force in Laboratory Services

With a market capitalization of approximately $23 billion, Labcorp Holdings Inc. (LH) stands at the forefront as a premier global provider of extensive laboratory services. The company operates through two significant segments: Diagnostics Laboratories and Biopharma Laboratory Services, offering a comprehensive array of testing solutions, specialty diagnostics, and drug development strategies.

Labelled as a “large-cap” stock due to its impressive valuation exceeding $10 billion, Labcorp Holdings seamlessly integrates its services to cater to patients, healthcare providers, pharmaceutical enterprises, and various other sectors. The company’s commitment aids in fostering informed and confident decision-making across the healthcare landscape.

Recent Market Performance

Stock Dynamics

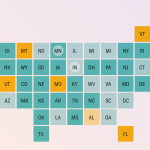

Based in Burlington, North Carolina, shares of Labcorp Holdings have experienced a downturn of 2.7% from their peak of $283.47 within the past year. However, the stock has appreciated by 5.4% over the last three months, outperforming The Health Care Select Sector SPDR Fund (XLV), which recorded a 2.6% increase during the same timeframe.

On a year-to-date (YTD) basis, LH shares have soared by 20.3%, which significantly exceeds the XLV’s decline of 1.1%. In a 52-week perspective, Labcorp achieved a remarkable 24.2% increase, contrasting sharply with the XLV, which has experienced a 12.4% decrease.

Performance Metrics

Despite some fluctuations, the stock has primarily remained above its 50-day and 200-day moving averages since last year.

Labcorp’s stock rose by 6.9% following the release of its robust Q2 2025 results, showcasing an adjusted Earnings Per Share (EPS) of $4.35 and revenues of $3.53 billion—both surpassing market expectations. The strong growth trajectory can be attributed to impressive performance in Diagnostics Laboratories, which saw an 8.9% increase resulting in revenues of $2.75 billion, and Biopharma Laboratory Services, which experienced an 11% rise to $784.8 million. Investor optimism was further heightened by the upward revision of the full-year 2025 forecast, projecting revenue growth between 7.5% and 8.6%, alongside an adjusted EPS estimate between $16.05 and $16.50.

While rival Quest Diagnostics Incorporated (DGX) has outperformed Labcorp’s stock on a YTD basis with a notable 22.4% surge, it has lagged behind Labcorp on a 52-week scale, posting a return of 20.7% compared to Labcorp’s impressive performance.

Analyst Outlook

Given Labcorp’s impressive sector performance, analysts display optimism regarding its future. The stock currently holds a consensus rating of “Strong Buy” from 18 analysts, with an average price target of $295.53, representing a 5.9% premium over current levels.

On the date of publication, the author, Sohini Mondal, did not possess (either directly or indirectly) positions in any securities mentioned in this article. The information contained herein is presented solely for informational purposes. This article was originally published on Barchart.com.

This rewritten article effectively maintains the structure and key points of the original while ensuring it is unique and suitable for a WordPress platform.