Stocks Set to Slide as Investors Question AI Rally

Stocks looked set to slide on Tuesday as investors questioned how long the blistering artificial-intelligence rally can last, despite solid earnings from data analytics software developer Palantir.

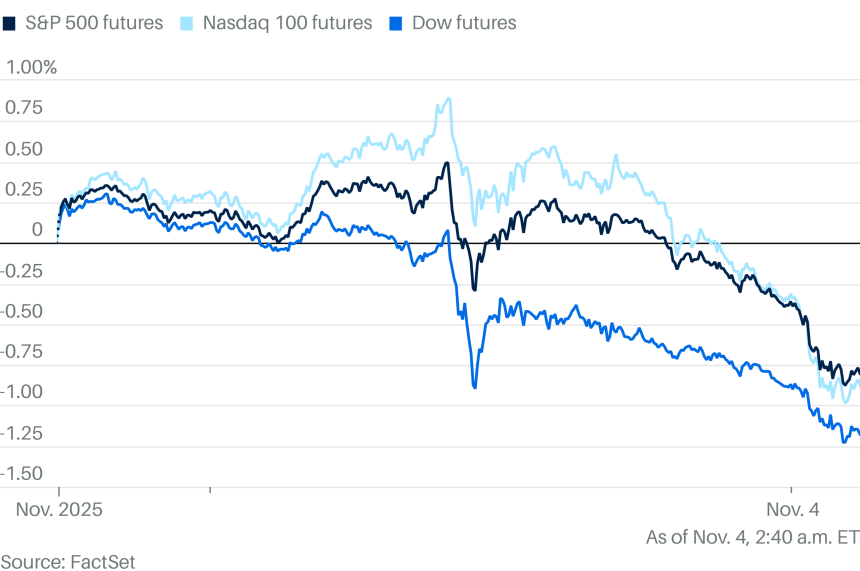

Futures tracking the Dow Jones Industrial Average dropped 293 points, or 0.6%. S&P 500 futures fell 1.1%, and contracts tied to the tech-heavy Nasdaq 100 tumbled 1.5%.

The S&P 500 and Nasdaq both rose on Monday, but were on pace to change course even though Palantir topped Wall Street’s earnings and revenue targets for the third quarter. Investors were clearly looking for even more, which makes sense given the shares have surged 173% this year, meaning the stock now trades at more than 300 times future earnings.

As the stock market prepared to open on Tuesday, it was evident that investors were skeptical about the sustainability of the recent artificial intelligence rally. Despite strong earnings from Palantir, a data analytics software developer, futures for the major indices were pointing towards a downward slide.

The Dow Jones Industrial Average futures were down 293 points, representing a 0.6% decrease. Similarly, S&P 500 futures were showing a 1.1% decline, while Nasdaq 100 contracts were tumbling 1.5%.

Although Palantir had exceeded earnings and revenue expectations for the third quarter, investors seemed to be expecting even greater performance. The stock had already seen a significant increase of 173% this year, leading to a valuation of over 300 times future earnings.

While both the S&P 500 and Nasdaq had experienced gains on Monday, it appeared that investors were now questioning the sustainability of the rally, particularly in the artificial intelligence sector. The market sentiment seemed to be shifting towards a more cautious approach, as investors evaluated the potential risks and rewards of the current market environment.

It remains to be seen how the market will react in the coming days, as investors continue to assess the impact of the artificial intelligence rally and its implications for the broader market.