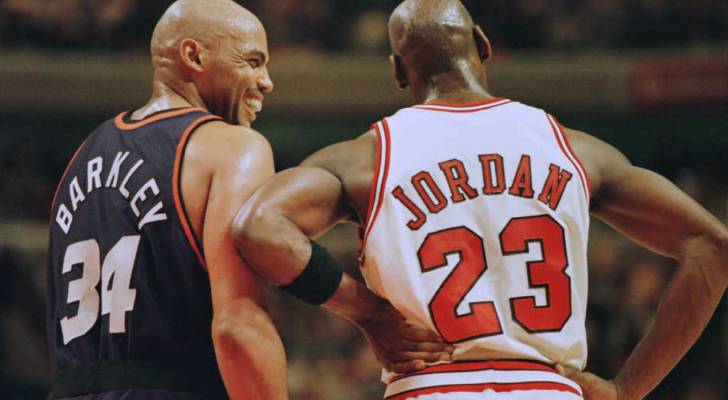

Young athletes often struggle to manage their finances, and former NBA star Charles Barkley was no exception. In a recent episode of The Steam Room podcast, Barkley revealed how a simple financial tip from his friend and fellow NBA legend, Michael Jordan, changed his life.

Back in the day, Barkley and Jordan were both on the verge of signing endorsement deals with Nike. Barkley’s deal was initially worth $3 million, but Jordan questioned him, asking, “Hey man, why you need all that money?” This simple question sparked a crucial conversation that led Barkley to a pivotal decision.

Instead of taking the $3 million in cash, Jordan advised Barkley to renegotiate his contract and accept $1 million in cash and the remaining $2 million in Nike stock options. Despite initial hesitation, Barkley followed Jordan’s advice and set himself up for a significant windfall in the future.

As Barkley proudly stated, this decision resulted in him making ten times the amount he would have received initially. Additionally, he has remained with Nike to this day, benefiting from the stock’s impressive growth of 4,000% since he first signed on.

Barkley’s story highlights the importance of gaining equity in a strong, growing business, rather than opting for a quick cash payout. This principle can be applied to anyone looking to build wealth and secure their financial future.

One way to implement this lesson is by focusing on capital appreciation and growth in your investment strategy, similar to how Jordan advised Barkley. Young investors, in particular, should prioritize growth over immediate cash flow to maximize their long-term returns.

One strategy to achieve this is by following the Rule of 100 for age-appropriate asset allocation. By subtracting your age from 100, you can determine the percentage of your portfolio that should be invested in stocks. For example, a 30-year-old would allocate 70% to stocks and 30% to safer investments like bonds.

Another approach is to regularly invest a portion of your paycheck in stocks. By saving a higher percentage of your income, such as 15%, you can accelerate your progress towards financial goals.

For those who may not have enough savings to invest in stocks each month, there are alternative methods to harness the power of compounding interest. Services like Acorns can help turn spare change from everyday purchases into investment opportunities, allowing you to build wealth gradually over time.

Furthermore, young investors with a higher risk tolerance can consider focusing on growth stocks rather than traditional blue-chip stocks. Consulting services like Moby can provide expert guidance on finding undervalued stock picks with the potential for significant returns.

By following these strategies and learning from Barkley’s experience with Jordan, investors can position themselves for long-term financial success. Remember, it’s not just about the initial payout but the value and growth potential of your investments that matter in the long run.