New Revised Estimates Show Strong Economic Growth

In a recent post, the claim was made that the overall inflation rate was not transitory as many had predicted. The reason being that all cumulative inflation since 2019 is demand-side and therefore permanent. PCE inflation has exceeded the Fed’s 2% target by nearly 8% over the past 5 years, with NGDP growth exceeding 4%/year by roughly 10%. This excess demand has been the driving force behind inflation, with supply shocks playing a minimal role. The Fed’s luck in managing this situation has been emphasized, with the revision now indicating that they got very lucky.

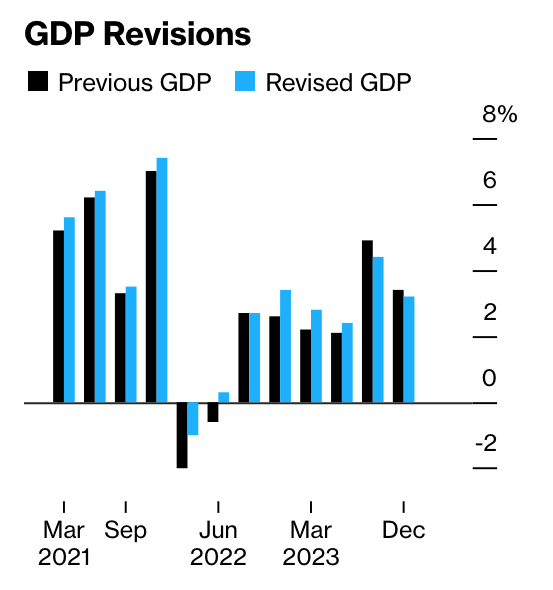

Today, the government released revised estimates of GDP growth for the years 2021-2023. According to Bloomberg, real output data has been updated, with NGDP also seeing a similar adjustment. The graph below illustrates the changes in real output:

Several key observations can be made from the revised data:

- There was no recession in 2022, as previously thought, with the revised data showing no negative quarters of real GDP growth.

- The overshoot of NGDP growth was actually 11.5%, indicating even more excessive monetary policy than initially believed.

- The strong supply side of the economy helped keep excess inflation to roughly 8%, lower than expected from monetary policy alone.

- Gross domestic income (GDI) was revised upward more significantly than GDP, closing the gap between the two.

The graph below illustrates the revised GDI growth:

Overall, the revised estimates paint a picture of strong economic growth, with the absence of a recession in 2022 and a clearer understanding of the role of demand-side factors in driving inflation. The economy’s potential may be higher than previously assumed, possibly due to increased immigration and improved productivity.