The impact of climate change on insurance markets in the United States is becoming increasingly evident as extreme weather events become more frequent and severe. In 2024 alone, five hurricanes made landfall, causing half a trillion dollars in damages, while flooding and wildfires ravaged communities across the country. As a result, insurance premiums have skyrocketed, with many homeowners facing the possibility of being dropped by their insurers altogether.

A recent analysis by the Senate Committee on the Budget revealed that the rate of insurance contracts being dropped has increased significantly in states most exposed to climate risks. In the past few years, 1.9 million policies were not renewed, highlighting the growing economic threat posed by climate change. Senator Sheldon Whitehouse emphasized the urgency of addressing this issue, stating that it is not just an environmental problem, but also an affordability issue that cannot be ignored.

Insurance premiums have seen a sharp increase in recent years, with a 44 percent rise between 2011 and 2021, followed by another 11 percent increase in 2023. The Joint Economic Committee’s report highlighted the challenges faced by homeowners as insurance models struggle to cope with the escalating climate risks. States like Florida have experienced the highest premium increases and non-renewal rates, reflecting the widespread impact of climate-exacerbated disasters.

Experts warn that costly natural disasters are becoming more frequent, putting immense financial pressure on insurance providers and reinsurers. As a result, insurers are pulling out of high-risk states, leaving homeowners with limited options for coverage. Government-backed insurers of last resort have seen a surge in enrollment, covering over $1 trillion in assets and highlighting the need for federal intervention in the insurance market.

The JEC report proposes several measures that Congress could take to address the insurance crisis, including data collection initiatives and tax incentives for disaster mitigation improvements. Adapting homes to withstand climate risks and future-proofing new constructions are seen as essential steps in stabilizing insurance markets. Additionally, the possibility of the federal government becoming a re-insurer to backstop climate-stressed insurance markets is being considered, although progress on such initiatives remains uncertain.

With the political landscape shifting and Republicans taking control of Congress, the future of these proposed measures is unclear. However, the economic implications of the insurance crisis may provide a common ground for bipartisan action in addressing the challenges posed by climate change on the insurance industry. As the frequency and severity of natural disasters continue to rise, finding sustainable solutions to protect homeowners and mitigate financial risks will be crucial in safeguarding communities across the nation. As wildfires continue to rage across the globe and flooding becomes more frequent, it is clear that these environmental disasters are not going away anytime soon. The increasing frequency and intensity of these events are a stark reminder of the urgent need to address climate change and its impact on our planet.

Wildfires have become a common occurrence in many parts of the world, fueled by dry conditions and high temperatures. In recent years, we have seen devastating wildfires in California, Australia, and the Amazon rainforest, causing widespread destruction of homes, wildlife, and natural habitats. These fires not only have immediate consequences, but they also release large amounts of carbon dioxide into the atmosphere, contributing to global warming.

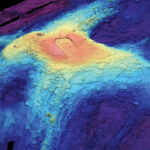

On the other hand, flooding has also become a major concern, with rising sea levels and more intense rainfall events leading to widespread flooding in coastal areas and river basins. In some regions, flash floods occur with little warning, causing significant damage to infrastructure and posing a threat to human lives.

The link between wildfires and flooding is complex but undeniable. Wildfires can increase the risk of flooding by stripping vegetation from the land, reducing soil stability, and increasing the likelihood of erosion. In turn, flooding can exacerbate the impact of wildfires by washing away fire-damaged areas, spreading debris, and contaminating water sources.

As we continue to witness the devastating effects of wildfires and flooding, it is crucial that we take action to mitigate the impact of these disasters. This includes implementing sustainable land management practices, investing in resilient infrastructure, and reducing greenhouse gas emissions to slow the pace of climate change.

It is clear that the issue of wildfires and flooding is not going away. We must act now to protect our planet and future generations from the catastrophic consequences of these environmental disasters. Only by working together and taking decisive action can we hope to address the root causes of these events and build a more sustainable and resilient future.