The cryptocurrency market experienced a significant downturn on Monday, witnessing nearly a complete loss in value across various assets. The total market capitalization for all cryptocurrencies fell below the $4 trillion mark, a stark contrast to the previous day’s performance.

Bitcoin (BTC-USD) declined by 3%, while its closest competitor, ether (ETH-USD), saw a greater fall of 6%. Solana’s token (SOL-USD) suffered a 7% drop. Meanwhile, both Dogecoin (DOGE-USD) and World Liberty Financial (WLF) experienced a drastic plunge of 10% each.

Over the course of Sunday night, approximately $1.7 billion in trading positions were liquidated within the crypto derivatives market, as reported by data analytics firm Coinglass. A staggering 94% of these liquidations originated from bullish positions, with OKX seeing the largest single liquidation worth $12.7 million.

Liquidations for traders betting on ether reached over $500 million, while bitcoin positions amounted to $280 million. These market movements followed the Federal Reserve’s announcement pointing towards a reduction of its short-term policy rate by a quarter of a percentage point, which stirred market uncertainty last week.

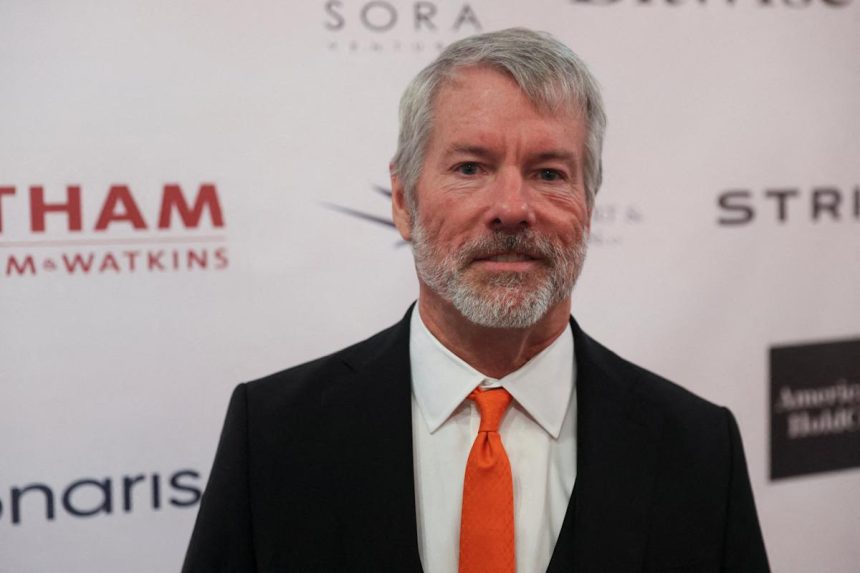

Publicly traded companies with significant Bitcoin holdings, often referred to as crypto treasury companies, have encountered mounting pressure in recent weeks. Many had previously experienced dramatic surges in stock value but are now grappling with volatility. There are currently over 180 public entities that have integrated Bitcoin into their financial portfolios, as highlighted by data from BitcoinTreasuries.net. Many of these companies were established recently with the aim to replicate the remarkable success of Michael Saylor’s bitcoin-centric firm, Strategy (MSTR).

As for Strategy’s stock (MSTR), it has retracted by 1.3% recently. The company embarked on aggressive bitcoin acquisition starting in 2020, utilizing a blend of debt and equity financing, which transformed the business intelligence firm into a formidable asset within the cryptocurrency sector. Even with its recent stagnation, the stock has appreciated dramatically—growing by 2,200% since commencing its bitcoin investments.

Among the firms venturing into this space, around 94 have been identified as mimickers of Strategy, particularly regarding their operational scope and investment strategies, according to Vetle Lunde, an analytical leader from the Oslo-based research firm K33. Notably, approximately 25% of these firms have market valuations that have dipped below their bitcoin asset values, a trend noted by K33 Research.

This evolving landscape has catalyzed the first consolidation within the bitcoin treasury domain. On Monday, shares of Semler Scientific (SMLR), a health tech firm that pivoted to a bitcoin treasury model, surged by 27% following their announcement of an acquisition by the larger bitcoin treasury entity Strive Inc. (ASST), which is backed by Vivek Ramaswamy, through an all-stock transaction.