Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favorite stories in this weekly newsletter.

Nvidia insiders have sold more than $1bn of the company’s stock over the past 12 months including a recent surge in trading as executives cash in on investors’ enthusiasm for artificial intelligence. More than $500mn of the share sales took place this month as the California-based chips designer’s share price climbed to a record high. Investors have piled back into the stock, making it the world’s most valuable company as they bet on huge demand for chips to power AI applications. The price rise comes after a turbulent year in which Nvidia was knocked by US-China trade tensions and Chinese AI breakthroughs that threatened demand for its products.

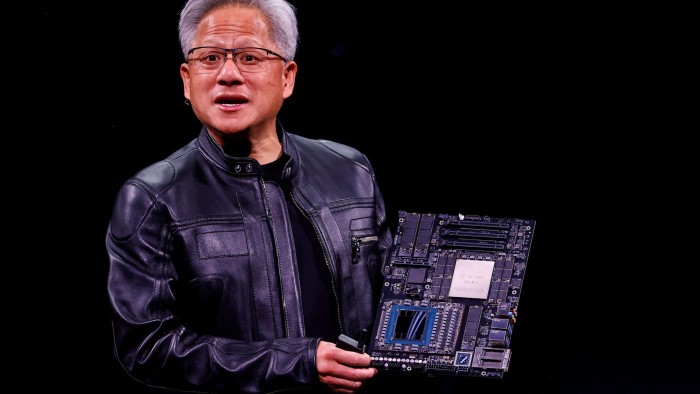

Jensen Huang, Nvidia chief executive, started selling shares this week for the first time since September. Nvidia said all of Huang’s sales were part of a pre-arranged trading plan, agreed in March, that set the prices and dates at which sales would be triggered. Huang still retains the vast majority of his shares in Nvidia.

“When the stock [dropped] in the first quarter, he did not sell, [which was] really smart,” said Ben Silverman, vice-president of research at VerityData. “[Huang] waited for the stock to return to levels that he felt more comfortable selling at,” Silverman added.

VerityData, which tracks insider sales based on regulatory filings, said in a report that Nvidia’s share price bump above $150 appears to have triggered Huang’s sales. Huang started selling just after a mandated 90-day cooling-off period for his sales plan expired. Directors and senior executives often agree these plans to avoid insider trading allegations. Under the plan, Huang can sell as many as 6mn shares before the end of this year. At the current share price, that leaves Huang on track to earn more than $900mn.

Huang’s net worth is estimated at $138bn, according to Forbes. Nvidia’s market capitalization has quadrupled to $3.8tn in the space of a few years as companies and nation states pour billions of dollars into the infrastructure behind AI. A number of other top Nvidia executives are also reaping a windfall from the company’s growth.

These include longtime board member Mark Stevens, a former managing partner at Sequoia Capital who was one of the earliest investors in Nvidia. On 2 June, he announced he would sell up to 4mn shares, currently valued at $550mn, and has since sold $288mn of them. Nvidia’s executive vice-president of worldwide field operations, Jay Puri — a two-decade veteran of the company who has deputized for Huang on trips to China to meet officials — sold shares worth around $25mn on Wednesday. Two other board members, Tench Coxe and Brooke Seawell, have moved to sell, with Coxe offloading around $143mn on June 9 and Seawell around $48mn this month.

Coxe, a former managing director of Sutter Hill Ventures, is another longtime board member who has been at the company since its early days. Huang co-founded the company in 1993 as a video game graphics card company in a Denny’s restaurant in San Jose. Seawell, who joined the board in 1997, is a partner at venture firm New Enterprise Associates and a former executive at chip design software company Synopsys.

Nvidia’s shares have rebounded in recent weeks, with its market capitalization regaining about $1.5tn since its lowest point in April. The stock took a hit following breakthroughs by China’s DeepSeek and new US export controls on AI chips destined for China. The world of technology is constantly evolving, with new innovations and advancements being made every day. One area that has seen significant growth in recent years is artificial intelligence (AI). AI is the simulation of human intelligence processes by machines, especially computer systems. It has the ability to learn, reason, and self-correct, making it a powerful tool in a variety of industries.

One of the most exciting developments in AI is the rise of natural language processing (NLP). NLP is a branch of AI that focuses on the interaction between computers and humans using natural language. This technology allows machines to understand and generate human language, enabling them to communicate with users in a more natural and intuitive way.

NLP has a wide range of applications, from virtual assistants like Siri and Alexa to chatbots that provide customer service on websites. These tools use NLP to understand and respond to user queries, making it easier for people to interact with technology. NLP is also being used in fields like healthcare, finance, and marketing to analyze and extract valuable insights from large amounts of text data.

Another exciting development in AI is the use of deep learning algorithms. Deep learning is a subset of machine learning that uses artificial neural networks to model and process complex data. These algorithms have been instrumental in advancing AI capabilities, enabling machines to perform tasks like image recognition, speech recognition, and natural language understanding.

Deep learning is being used in a variety of industries, from healthcare to autonomous vehicles. For example, in healthcare, deep learning algorithms are being used to analyze medical images and diagnose diseases with a high degree of accuracy. In autonomous vehicles, these algorithms are used to process sensor data and make real-time decisions about driving conditions.

Despite the many benefits of AI, there are also concerns about its impact on society. Some worry that AI will lead to job losses as machines take over tasks that were previously done by humans. There are also ethical concerns about the use of AI in areas like surveillance and decision-making.

Overall, AI is a powerful technology that has the potential to revolutionize the way we live and work. As long as we approach its development and implementation responsibly, AI has the power to improve our lives in countless ways. The future of AI is bright, and we can expect to see even more exciting developments in the years to come.