The market can be merciless. It often overlooks reputations in the short term, as evidenced by the recent movements in Nvidia’s (NVDA) stock. Despite being recognized as the world’s most valuable company and possessing an impressive 90% share of the GPU industry, Nvidia’s shares experienced a slight dip after AMD (AMD) announced a collaboration with OpenAI, the creator of ChatGPT.

This is a positive development for AMD and a healthy indication for the entire semiconductor sector, revealing that hyperscalers are not solely leaning on Nvidia to advance their AI initiatives. However, the market’s response to Nvidia seemed excessively harsh since the long-term growth potential for Nvidia remains unchanged, with analysts continuing to maintain a positive outlook on the company.

-

The Chart’s Flashing a New Warning: META Stock Could Tumble to $500 From Here

-

Trump Just Took a 10% Stake in Trilogy Metals. Should You Buy TMQ Stock Here?

But why this sharp reaction? Let’s delve deeper.

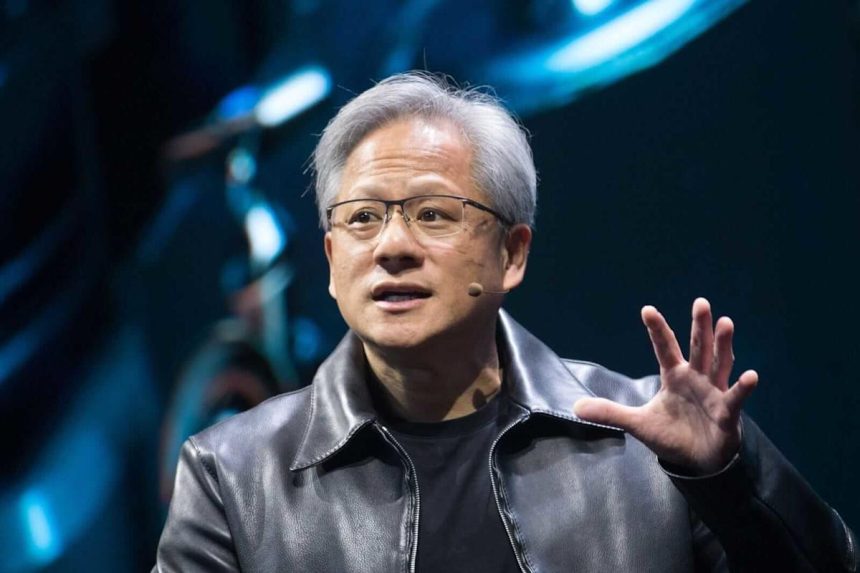

Even after the recent downturn, NVDA stock has increased by a notable 40.5% year-to-date (YTD), outperforming the S&P 500’s ($SPX) gain of 14.7%. Furthermore, Nvidia’s financial figures remain as impressive as CEO Jensen Huang’s collection of leather jackets.

Analyzing the company’s performance over the past decade reveals a robust growth trajectory, with compounded annual growth rates (CAGRs) for sales and earnings per share (EPS) hitting notable figures of 42.52% and 66.59%, respectively. Analysts project that this upward trend will persist, forecasting future revenue growth at 65.33% and EPS growth at 72.11%. These expected rates significantly exceed industry averages, which hover around 7.53% for revenue and 11.03% for earnings growth.

The latest quarterly earnings further highlight this momentum, as Nvidia surpassed analysts’ expectations. The company reported total revenues of $46.7 billion for the period, a remarkable 56% increase from the same quarter last year. Likewise, EPS was reported at $1.05, exceeding the Wall Street estimate of $1.01 and reflecting a 54% year-over-year (YoY) rise. The chief contributor to these outstanding results was the data center segment, which alone accounted for $41.1 billion in revenue, a 5% increase quarter-over-quarter (QoQ) and an astonishing 56% increase compared to a year ago.