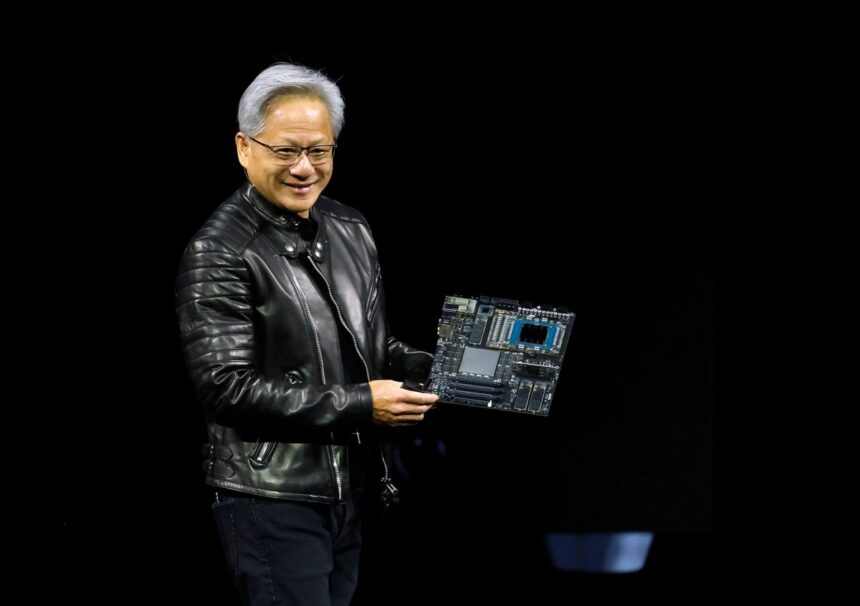

Nvidia founder and CEO Jensen Huang had a positive outlook during the company’s third-quarter earnings, and the results certainly support his optimism. Nvidia reported a staggering revenue of $57 billion in the third quarter, marking a 62% increase compared to the same period last year. The company’s net income on a GAAP basis also saw significant growth, reaching $32 billion, a 65% year-over-year increase, surpassing Wall Street’s expectations.

The standout performer for Nvidia was its data center business, which generated a record $51.2 billion in revenue, up 25% from the previous quarter and a remarkable 66% increase from the previous year. The remaining $5.8 billion in revenue came from Nvidia’s gaming business, professional visualization, and automotive sectors.

Nvidia’s CFO, Colette Kress, highlighted the strong performance of the data center business, attributing it to the increased demand for computing power, powerful AI models, and innovative applications. Kress mentioned that in the past quarter alone, Nvidia announced AI factory and infrastructure projects that involved a total of 5 million GPUs, catering to various markets such as CSPs, sovereigns, enterprises, and supercomputing centers.

One of Nvidia’s standout products, the Blackwell Ultra GPU introduced in March, has been exceptionally well-received and is now a flagship product for the company. Huang noted that the sales of Blackwell GPU chips have been exceptional, with cloud GPUs selling out due to high demand. The company is experiencing a surge in compute demand across training and inference, marking the beginning of a virtuous cycle in AI.

However, there were some challenges noted during the earnings call, particularly regarding the shipment of H20, a data center GPU designed for generative AI and high-performance computing. Kress mentioned that geopolitical issues and a competitive market in China resulted in disappointing shipment numbers for H20.

Looking ahead, Nvidia is optimistic about its growth prospects, with a projected revenue of $65 billion in the fourth quarter. This positive forecast has driven the company’s share price up by more than 4% in after-hours trading. Huang emphasized that despite concerns of an AI bubble, Nvidia sees continuous growth and opportunities in the AI industry.

In conclusion, Nvidia’s impressive third-quarter results and optimistic outlook for future growth solidify its position as a leader in the tech industry. The company’s focus on innovation, particularly in data center solutions and AI technologies, continues to drive its success and market performance.