Federal Reserve Chair Jerome Powell delivered a speech on Thursday emphasizing the strength of the U.S. economy and signaling a cautious approach to future interest rate cuts. Powell stated that the current economic growth in the country gives policymakers the flexibility to carefully consider the timing and extent of any rate adjustments.

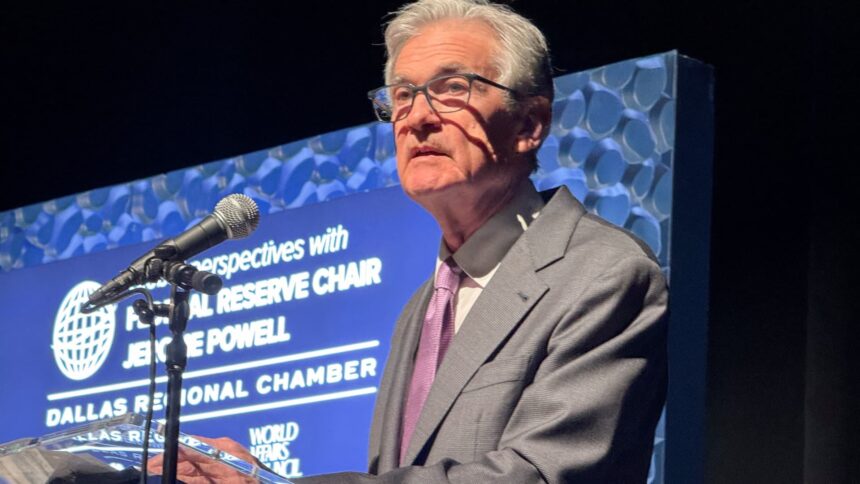

During his speech to business leaders in Dallas, Powell highlighted the robustness of the U.S. economy compared to other major economies around the world. He specifically pointed out that despite a slight setback in job growth in October due to storm damage and labor strikes, the labor market is still holding up well. Powell mentioned that the unemployment rate, although showing a slight increase, remains low by historical standards.

On the topic of inflation, Powell acknowledged the progress made in bringing inflation closer to the Federal Reserve’s 2% target. He noted that inflation data for October indicated a rate of 2.3%, or 2.8% excluding food and energy. Powell expressed confidence in the Fed’s ability to steer inflation towards the target, although he acknowledged that the path may not be without challenges.

Following Powell’s remarks, stock markets reacted by moving lower and Treasury yields increased. Traders also adjusted their expectations for a rate cut in December. This cautious stance on rate cuts comes after the Federal Open Market Committee recently lowered the benchmark borrowing rate by a quarter percentage point.

Powell emphasized that the Fed’s monetary policy is now focused on sustaining both the labor market and inflation, rather than solely targeting inflation as in the past. While markets anticipate further rate cuts in the coming months, Powell refrained from providing a specific forecast, stating that the path to a neutral rate setting is not predetermined.

The Fed’s balance sheet reduction process, which involves allowing proceeds from bond holdings to roll off each month, continues without a specified end date. Powell stressed the importance of striking the right balance between supporting the labor market and managing inflation as the Fed navigates the uncertain economic landscape.

In conclusion, Powell’s cautious approach to interest rate cuts reflects the Fed’s commitment to maintaining economic stability while addressing potential challenges. The central bank’s focus on a balanced monetary policy underscores its efforts to support sustainable economic growth in the long term.