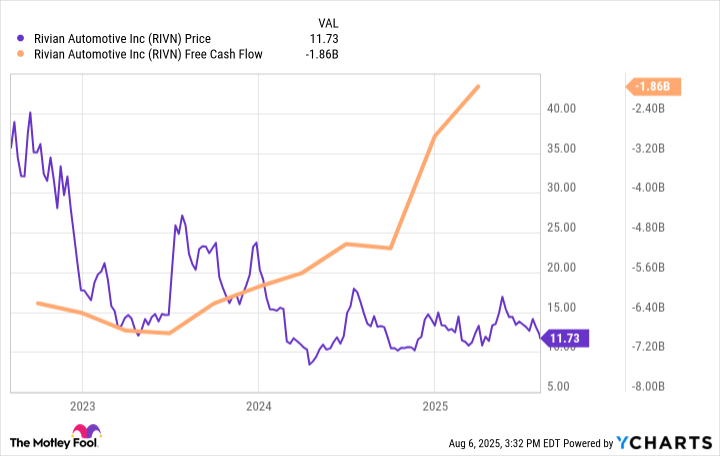

Rivian (NASDAQ: RIVN) recently reported its second quarter results, which were impacted by several factors. Despite a 13% increase in revenue to $1.3 billion and a reduced net loss of $1.1 billion compared to the previous year, the company also revised its full-year adjusted EBITDA loss forecast to be between $2 billion and $2.25 billion, worse than the previous estimate. Rivian reaffirmed its delivery guidance of 40,000 to 46,000 vehicles.

One of the major challenges Rivian faced was the sudden removal of regulatory credits. The Trump administration eliminated the penalty for not meeting emissions standards, which removed the incentive for automakers to purchase these credits from companies like Rivian. As a result, Rivian anticipates a significant drop in revenue from regulatory credits, from an expected $300 million to just $160 million in 2025.

Additionally, tariffs imposed by the current administration have had a negative impact on Rivian. The tariffs on imported auto parts have increased costs, eroded margins, and caused supply chain disruptions, leading to a decrease in vehicle production. These tariffs are expected to continue affecting Rivian’s cash flow and increase vehicle costs by a couple thousand dollars per unit for the rest of 2025.

Another challenge for Rivian is the removal of the $7,500 federal EV tax credit, which is set to expire at the end of September. This removal is likely to impact long-term demand for EVs, as it will make qualifying vehicles more expensive. The anticipation of the credit’s removal also created a surge in demand as consumers rushed to purchase EVs before the credit disappeared.

Looking ahead, Rivian needs a strong second half of the year to meet its full-year delivery target. The company expects the third quarter to be the strongest for deliveries, but it will be crucial to monitor demand and deliveries, especially after the pull-forward effect caused by the tax credit removal.

Despite these challenges, Rivian remains focused on its future models, such as the R2, R3, and R3X. The company’s success will depend on the performance of these models, and investors should consider the high-risk, high-reward nature of investing in Rivian. While the current environment presents obstacles for the company, there is potential for recovery and growth in the long term.

In conclusion, Rivian is facing a challenging year with multiple factors impacting its financial performance. The company’s ability to navigate these challenges and deliver on its future models will determine its success in the competitive EV market. Investors should carefully consider the risks and rewards associated with investing in Rivian.