Analysis of Recent Trade Tariff Proposals

Some bad news and then some good news and then some bad news.

Bad News

Recent developments in trade policies have seen President Trump announcing a potential 10% tariff rate on imports from China. This decision stems from concerns regarding the use of chemical ingredients by China to manufacture fentanyl in Mexico.

The proposed tariff rate of 10% comes as a surprise to some, as during his campaign, Trump had threatened a much higher rate of 60% on Chinese imports. Additionally, there are threats of a 25% tariff on imports from Mexico and Canada, further complicating the trade landscape.

Good News

Despite the negative implications of tariffs, there is a silver lining in the form of economic theory. The impact of a 10% tariff is significantly lesser than that of a 60% tariff, with calculations showing the damage being only 1/36th of the higher rate.

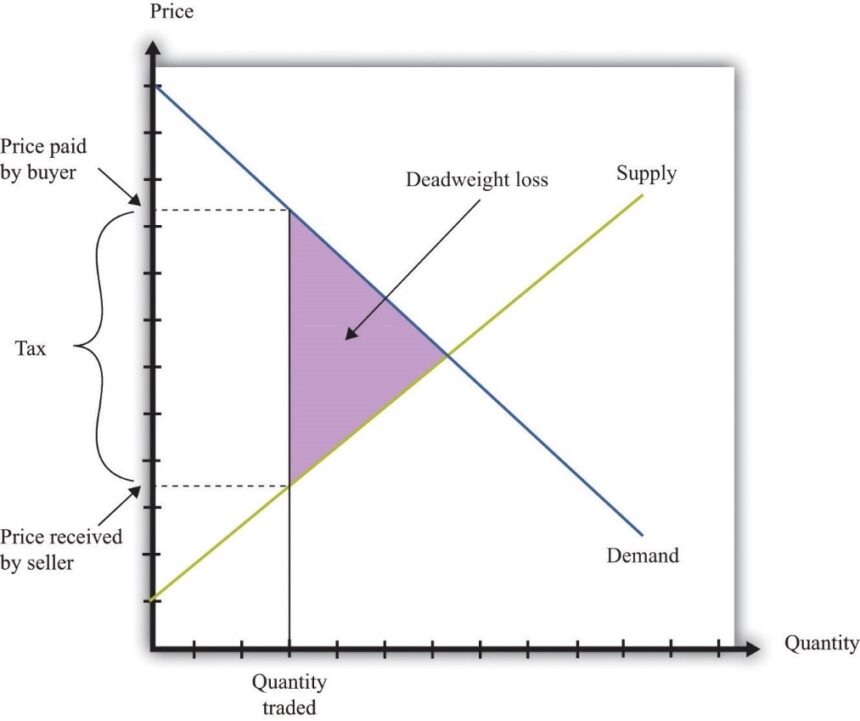

Economic principles dictate that the deadweight loss from a tax is not linearly correlated to the tax rate, but rather to the square of the tax rate. This means that the potential consequences of a 60% tariff are exponentially greater than those of a 10% tariff.

The deadweight loss refers to the reduction in consumer and producer surplus resulting from a tax.

Bad news

However, a deeper analysis reveals concerning aspects of the proposed tariffs. While the focus is on China, it is crucial to note that imports from Canada and Mexico collectively surpass those from China in terms of value.

The quantity of goods being taxed plays a significant role in determining the deadweight loss from tariffs. By factoring in the value of imports from Canada and Mexico, the potential impact of tariffs on these countries is substantially higher than that on China.

In summary, if the proposed tariffs of 10% on China and 25% on Canada and Mexico are implemented, the deadweight loss from the latter would be approximately 12.5 times greater than that of the former, highlighting the potential repercussions of such trade measures.

Notes: This analysis assumes a baseline tariff rate of 0 and simplifies certain aspects for clarity. The triangle in the image represents the deadweight loss incurred by taxes.