VONG and VOOG are two top-performing growth ETFs offered by Vanguard, catering to investors seeking exposure to the U.S. stock market. Both ETFs have the same low expense ratio and offer identical dividend yields. They are heavily invested in technology stocks, with key holdings in companies like Nvidia and Apple.

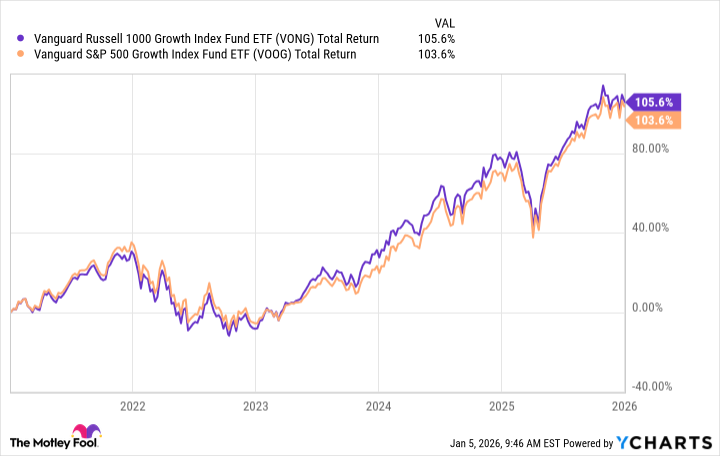

When comparing VONG and VOOG, it’s essential to consider factors like cost, performance, and portfolio composition. VONG tracks the Russell 1000 Growth Index, while VOOG follows the S&P 500 Growth Index. Despite similarities in cost and yield, VONG has a higher 1-year total return compared to VOOG.

In terms of sector allocation, both ETFs have a significant focus on technology stocks. VOOG has a heavier tech tilt, while VONG has a broader mix of sectors, including consumer discretionary and industrials. Both ETFs have large-cap growth stocks in their portfolios, with Nvidia, Apple, and Microsoft being prominent holdings.

Investors looking to invest in growth stocks may find either VONG or VOOG suitable for their portfolios. However, VONG offers more exposure to growth stocks, particularly in the tech sector, making it slightly more volatile than VOOG. Diversifying investments between the two ETFs could be a strategic move to capitalize on growth opportunities.

ETFs are exchange-traded funds that provide a diversified investment option for investors. They track specific market indices and offer a cost-effective way to invest in various sectors. With both VONG and VOOG being low-cost Vanguard ETFs, investors can access a broad range of U.S. growth stocks with large market capitalization.

In conclusion, VONG and VOOG are excellent choices for investors looking to add growth ETFs to their portfolios. While both ETFs have similarities in cost and performance, their index construction and sector allocations set them apart. Understanding these differences can help investors make informed decisions when choosing between VONG and VOOG for their investment strategy.