Investing in the AI/data center theme can be a lucrative opportunity for those looking to diversify their portfolio and capitalize on the growth in this sector. Two hidden gems in this space are Vertiv (NYSE: VRT) and nVent (NYSE: NVT), which provide critical solutions and services to data centers.

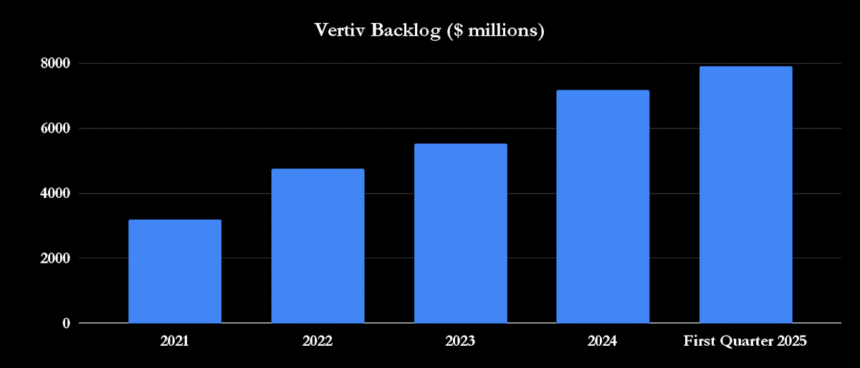

Vertiv specializes in digital infrastructure for data centers and communication networks, offering products such as power management, switchgear, thermal management, and monitoring infrastructure. The company has seen significant growth in its backlog, with orders continuing to increase in the first quarter of the year. With a market cap of $36.1 billion, Vertiv is well-positioned to benefit from the growing demand for AI applications and data center investment.

nVent, on the other hand, offers electrical connection and protection solutions to industrial, commercial, and residential customers, with a focus on data centers and power utilities. The company recently divested its thermal management business and acquired the electrical products group business of Avail Infrastructure Solutions to increase its exposure to these attractive end markets. nVent’s strong performance in the first quarter led to an increase in its full-year sales and earnings growth guidance.

Both Vertiv and nVent present attractive investment opportunities in the AI/data center space, with analysts forecasting solid earnings and free cash flow growth for both companies in the coming years. With the continued growth in data center spending and the increasing demand for AI applications, these stocks have the potential to deliver strong returns for investors.

Before making any investment decisions, it’s essential to conduct thorough research and consider the advice of financial experts. By staying informed and keeping an eye on market trends, investors can make informed decisions that align with their financial goals.