Nvidia (NASDAQ: NVDA) has been a standout performer in the stock market over the past five years, with its value skyrocketing by nearly 1,500%. Despite this impressive growth, many investors may still be wondering if it’s too late to jump on the Nvidia bandwagon. However, a closer look at the company’s financials and future prospects reveals that there is still plenty of upside potential for long-term investors.

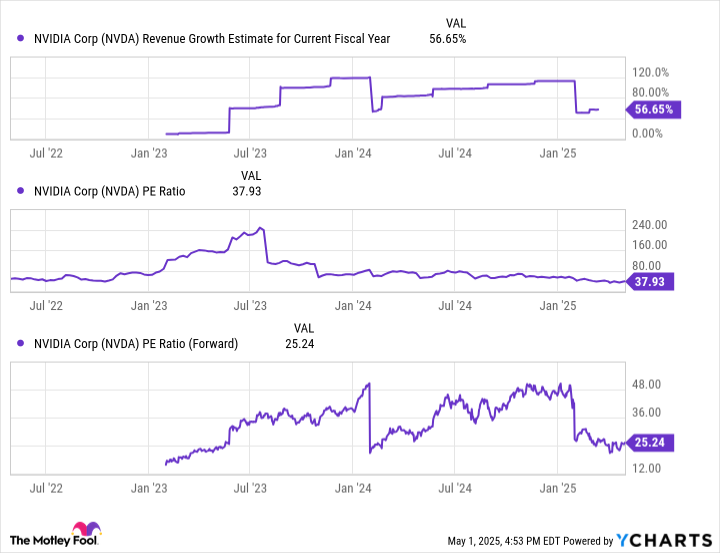

From a price-to-sales perspective, Nvidia shares may appear to be trading at a steep premium, with a valuation of 21 times sales and a market cap of around $3 trillion. This puts Nvidia in rare company, as few companies of this size have commanded such high multiples. However, when considering the company’s profitability, Nvidia’s price-to-earnings ratio tells a different story. At just 25 times forward earnings, based on analyst expectations for the next 12 months, Nvidia’s valuation is more in line with the market average.

In comparison to the S&P 500, which trades at 28 times earnings, Nvidia’s 35% premium may seem justified given its position as a highly profitable player in the rapidly growing artificial intelligence market. With sales continuing to climb at 50% or more annually, Nvidia’s forward price-to-earnings ratio of 25 indicates that the stock is not as overvalued as it may initially appear. As the company’s growth trajectory continues, this valuation premium is expected to shrink over time, potentially leading to Nvidia shares trading at a discount relative to the market.

Looking ahead, Nvidia’s strong growth prospects in AI technology suggest that there is still significant room for the stock to appreciate. While patience may be required for this potential to fully materialize, it is clear that Nvidia is far from being overvalued based on its earnings potential.

For investors who may have missed out on the opportunity to invest in other successful stocks in the past, now could be the perfect time to consider Nvidia. With the company poised for continued growth and profitability, Nvidia presents an attractive investment opportunity for those looking to capitalize on the future of AI technology.

In conclusion, Nvidia’s impressive performance over the past five years is a testament to the company’s strength and resilience in a rapidly evolving market. As the demand for AI technology continues to grow, Nvidia’s stock remains a compelling option for investors seeking long-term growth potential.