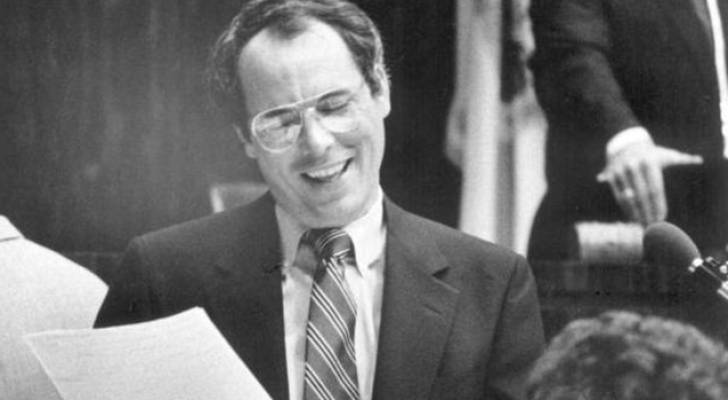

Pat Neal, the Florida Senate Appropriations chairman, is a billionaire with a net worth estimated at $1.2 billion. Despite his wealth, Neal has a unique approach to investing – he doesn’t own any stocks or bonds. Instead, he prefers to reinvest in his own company, Neal Communities, a successful land development and homebuilding business he founded in 1970. Over the years, Neal Communities has built an impressive 25,000 homes across Florida.

Neal’s aversion to stocks and bonds stems from a desire to control his own future. He learned this lesson early on in his investment journey. In his teens, Neal had some success dabbling in stocks, but a bad experience with a Florida-based company called Delta Corporation turned him off the stock market for good. After losing money on a failed investment, Neal decided to focus on real estate and never looked back.

Neal’s investment strategy is simple but effective – he spots opportunities before the crowd. By staying informed, scouting properties, and making smart land purchases, Neal has been able to build a successful real estate empire. One of his most notable investments was in the late 1980s when he purchased 1,087 acres in Sarasota County for a bargain price. When the surrounding infrastructure improved, Neal was able to sell the land at a significant profit.

For those looking to follow in Neal’s footsteps but lack the time or capital to invest in large parcels of land, there are now more accessible options available. Crowdfunding platforms like Arrived allow everyday investors to gain exposure to the real estate market without the hassle of property management. Investors can purchase shares of rental homes with as little as $100 and start receiving rental income distributions.

Another option for investors is First National Realty Partners (FNRP), which offers opportunities to own shares of grocery-anchored commercial properties leased by national brands like Whole Foods and Walmart. With a minimum investment of $50,000, accredited investors can diversify their portfolio without the responsibilities of being a landlord.

For those looking for a more comprehensive wealth management solution, Range is a modern platform that offers investment management, tax planning, estate planning, retirement guidance, and insurance optimization all in one place. Real estate investors will find Range particularly useful for structuring deals, forecasting cash flow, planning long-term strategies, and minimizing tax exposure.

Overall, investing in real estate is no longer limited to high-net-worth individuals like Pat Neal. With a range of options available, investors of all backgrounds can access the lucrative real estate market and build their own wealth. As with any investment, it’s important to do thorough research and consider all options before making any financial decisions.