Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

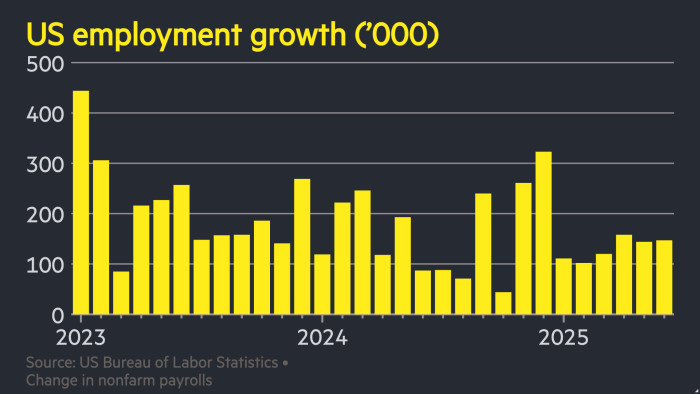

The US economy added 147,000 jobs in June, surpassing expectations and causing investors to rethink their bets on interest rate cuts. Despite concerns over President Donald Trump’s trade and immigration policies, the Bureau of Labor Statistics reported a higher number of job additions than anticipated. This figure exceeded both the revised May numbers and the predictions made by economists.

The unemployment rate also saw a slight decrease to 4.1 percent, with revisions showing an increase in job numbers from April. These unexpected positive figures are likely to reduce the pressure on the US Federal Reserve to implement interest rate cuts, despite President Trump’s persistent calls for such actions.

Following the release of the data, the dollar strengthened as investors adjusted their expectations for rate cuts by the Fed. The currency saw a 0.5 percent increase against a basket of rival currencies.

Traders are now estimating a lower probability of a rate cut by the central bank this month, compared to before the job data was released. Andy Brenner, head of international fixed income at NatAlliance Securities, commented on the unexpected job numbers, suggesting that a rate cut in July is now unlikely.

President Trump has been vocal in his demands for rate cuts, arguing that the reluctance to do so has had negative consequences for the US economy. Despite initial indications from Fed Chair Jay Powell that a rate cut was possible in July, analysts remain cautious about the overall health of the job market.

While the headline figures point to a strong job market, some analysts are concerned about the lack of turnover in employment. The drop in the unemployment rate was largely attributed to people leaving the labor market rather than finding new jobs, indicating underlying issues in the job market.

The rise in employment figures was driven by growth in healthcare jobs and an unexpected increase in state government employment. Federal government jobs continued to decline due to cost-cutting measures, with a significant decrease in jobs since the beginning of the year.

Overall, while the job report was positive, analysts caution that the initial numbers may not fully capture the true state of the job market. The two-year Treasury yield increased following the release of the data, and the S&P 500 also saw a modest rise in early trading.

In conclusion, the job market in the US showed signs of strength in June, but underlying issues and caution from analysts suggest that a more nuanced approach is needed to fully assess the health of the economy.