Unlock the White House Watch newsletter for free

Are you curious about what Trump’s potential second term could mean for Washington, business, and the world? Look no further than the White House Watch newsletter, your comprehensive guide to staying informed on the latest developments.

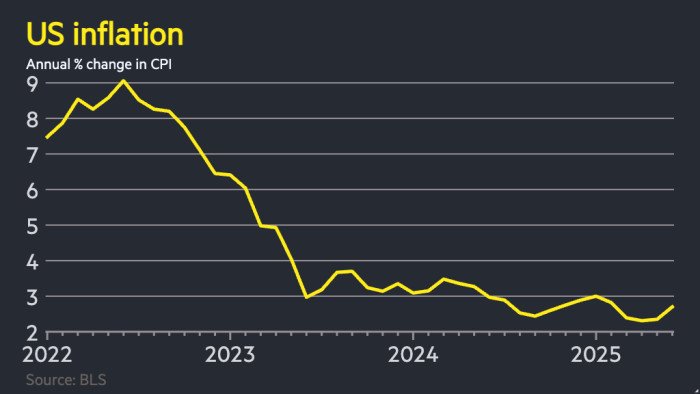

In recent news, US inflation has climbed to 2.7 per cent in June, exceeding expectations and indicating that Donald Trump’s tariffs are starting to impact prices. The annual consumer price index figure for Tuesday was up from 2.4 per cent in May and surpassed the projected 2.6 per cent among analysts surveyed by Bloomberg.

As the US president intensifies his tariff war with trading partners, threatening to impose significant levies on importers if trade deals are not reached, the effects of tariffs are becoming more apparent. Businesses have been absorbing a significant portion of the impact, but the recent data from the Bureau of Labor Statistics shows that tariffs are beginning to bite.

Trump has implemented a variety of tariffs since taking office, with a baseline rate of 10 per cent and sector-specific levies. While he has delayed the introduction of steeper reciprocal duties until August 1, the effects of tariffs on inflation are becoming more evident.

The rise in June’s inflation was partially driven by higher food prices but offset by weaker commodity prices. Annual core inflation, which excludes volatile food and energy prices, also rose by 2.9 per cent, in line with expectations.

Following the publication of the data, traders in the futures market slightly increased their bets on interest rate cuts, expecting two reductions by the end of the year. The dollar experienced a slight decline against other currencies, while Treasury yields and stock futures remained relatively stable.

Despite the market’s muted reaction to the inflation figures, there is still a possibility that inflation could pose a future challenge. President Trump has been urging US Federal Reserve Chair Jay Powell to lower interest rates by as much as 3 points to reduce the country’s debt payments. However, most members of the Fed’s rate-setting committee are hesitant to make any cuts until the impact of tariffs on inflation becomes clearer.

While two members of the committee have expressed openness to a rate cut as soon as this month, the majority are taking a more cautious approach. This story is still developing, so stay tuned for further updates.

Don’t miss out on crucial insights into the impact of Trump’s policies on the economy and global markets. Subscribe to the White House Watch newsletter today for free access to exclusive content and analysis.