Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

US stocks rallied on Friday, wiping out steep losses following Donald Trump’s “liberation day” announcement of steep tariffs a month ago, after data on the labour market exceeded expectations.

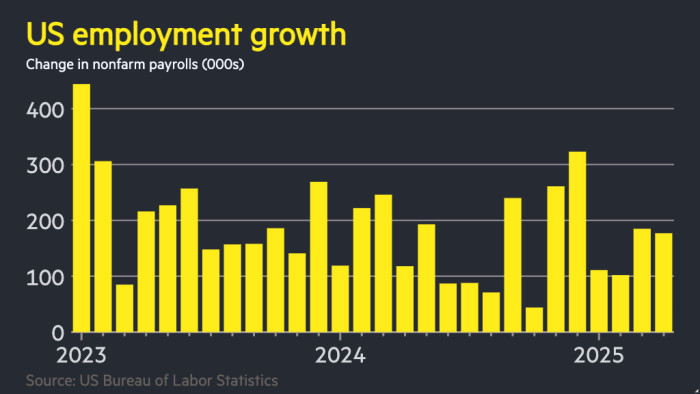

The 177,000 jobs added in April, according to the Bureau of Labor Statistics, surpassed the 135,000 predicted by economists polled by Bloomberg, although the number marked a fall from March’s downwardly revised 185,000 posts.

The S&P 500 jumped as much as 1.4 per cent on Friday morning, bringing it above the closing level from April 2, when Trump unveiled his so-called “reciprocal tariffs”.

Wall Street’s benchmark share index had plunged as much as 15 per cent in several days of turbulent trading following the US president’s announcement, triggering tumult across global financial markets.

But global equities have since largely recovered, helped by signs of a possible thaw in trade tensions, including comments by China’s commerce ministry on Friday that Washington had recently expressed “a desire to engage in discussions” on the issue.

“This rally seems to be on the expectation that — with regards to tariffs — the worst has passed,” said Ajay Rajadhyaksha, global chair of research at Barclays. But he added: “In fact it is exactly the contrary. The worst has not yet shown up in the data. Nothing has shown up in the data yet.”

After Friday’s jobs data, the yield on two-year Treasuries, which tracks interest rate expectations and moves inversely to prices, rose 0.08 percentage points to 3.78 per cent as investors bet that the US Federal Reserve would keep borrowing costs higher for longer.

“People were fearful of a downside surprise that wasn’t forthcoming,” said Mike Riddell, a fund manager at Fidelity International.

Traders in the futures market scaled back expectations of interest rate cuts this year, though are still betting on three or four cuts this year, beginning in July.

“THE FED SHOULD LOWER ITS RATE!!!” Trump posted on his Truth Social network shortly after the jobs data came out, as he hailed “employment strong, and much more good news”.

Friday’s jobs numbers came after mass firings of thousands of federal employees by Elon Musk’s so-called Department of Government Efficiency.

Friday’s data indicated that federal government employment declined by 9,000 in April and by 26,000 since January.

The overall unemployment rate was unchanged at 4.2 per cent.

Claudia Sahm, chief economist at New Century Advisors, said that while Trump’s economic policies were “anything but subtle” their initial impact was “relatively small”.

She added that it would take time for them “to work through the system, which means the Fed is going to wait”, and that any cuts were likely later in the second half of the year rather than at the central bank’s meetings during the next two months.

Official data this week indicated the first fall in GDP for three years but was distorted by a surge in imports ahead of Trump’s trade tariffs, with domestic demand remaining strong.

Many economists anticipate that the duties will act as a drag on underlying growth in the second quarter of the year.

“Overall this is an indication that the labour market is not deteriorating yet,” Gennadiy Goldberg, head of US rates strategy at TD Securities, said of Friday’s job data. “But investors are still nervous that another shoe will drop. We just don’t know when.”

Additional reporting by Ian Smith in London

To read more exclusive content and stay updated with the latest news, sign up for the Editor’s Digest for free. Editor Roula Khalaf handpicks her favorite stories each week to keep you informed and engaged. Subscribe now for a curated selection of top stories delivered straight to your inbox.