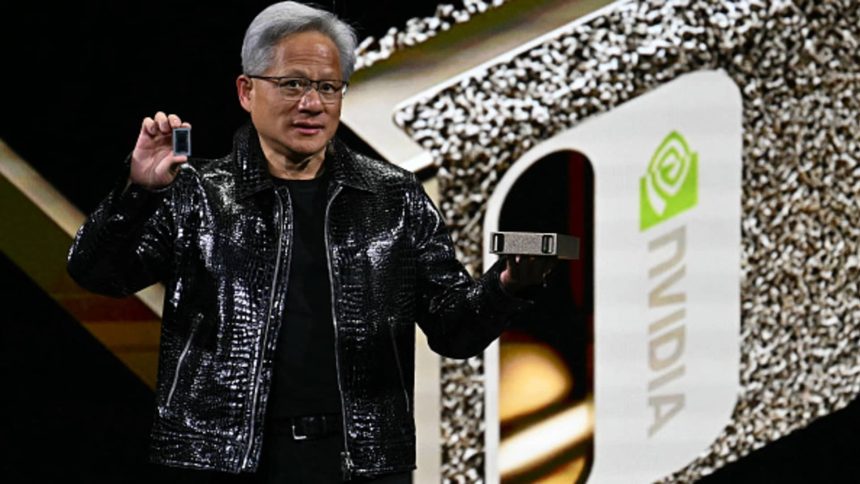

The semiconductor sector has been gaining a lot of attention due to the AI boom and the success of Nvidia, which is now the largest stock in the U.S. market. With Nvidia’s market cap exceeding $4 trillion, there have been concerns about the S&P 500’s concentration in tech stocks. However, for investors with an aggressive investment strategy, focusing on chip stocks can be a lucrative option.

One popular way to invest in the semiconductor sector is through the VanEck Semiconductor ETF (SMH). This ETF includes top players in the industry such as Nvidia, TSMC, and ASML, and has seen significant growth, up nearly 30% since the beginning of the year. The success of SMH can be attributed to its strong team of winners and the increasing demand for AI technology.

In addition to SMH, there are other ETFs like the iShares Semiconductor ETF (SOXX) and the Invesco PHLX Semiconductor ETF (SOXQ) that offer exposure to the chip sector. The SPDR S&P Semiconductor ETF (XSD) takes a different approach by equal-weighting its holdings, providing a more balanced exposure to the sector. This strategy has paid off, with XSD outperforming other semiconductor ETFs this year.

Another ETF worth considering is the Invesco Semiconductors ETF (PSI), which uses a custom index to select semiconductor companies based on various factors. This approach allows for exposure to mid-cap companies that may not be included in larger ETFs. With top holdings like Micron Technology and Qualcomm, PSI offers a unique investment opportunity in the semiconductor sector.

For investors looking for more focused exposure, the VanEck Fabless Semiconductor ETF (SMHX) focuses on fabless chipmakers, which design and sell chips but outsource manufacturing. This ETF includes pure-play fabless companies like Cadence Design Systems and Monolithic Power, providing a different perspective on the semiconductor industry.

Overall, the semiconductor sector is experiencing a super cycle with significant growth potential. Investors who are bullish on technology and AI may consider adding semiconductor ETFs to their portfolio. With a variety of options available, there are plenty of opportunities to capitalize on the success of the semiconductor industry.