Nvidia, one of the world’s leading semiconductor companies, is set to report its fourth-quarter earnings after the closing bell on Wednesday. Investors are eagerly awaiting the results, especially in light of recent developments surrounding the demand for Nvidia’s next-generation Blackwell chip and concerns raised by China’s DeepSeek AI model.

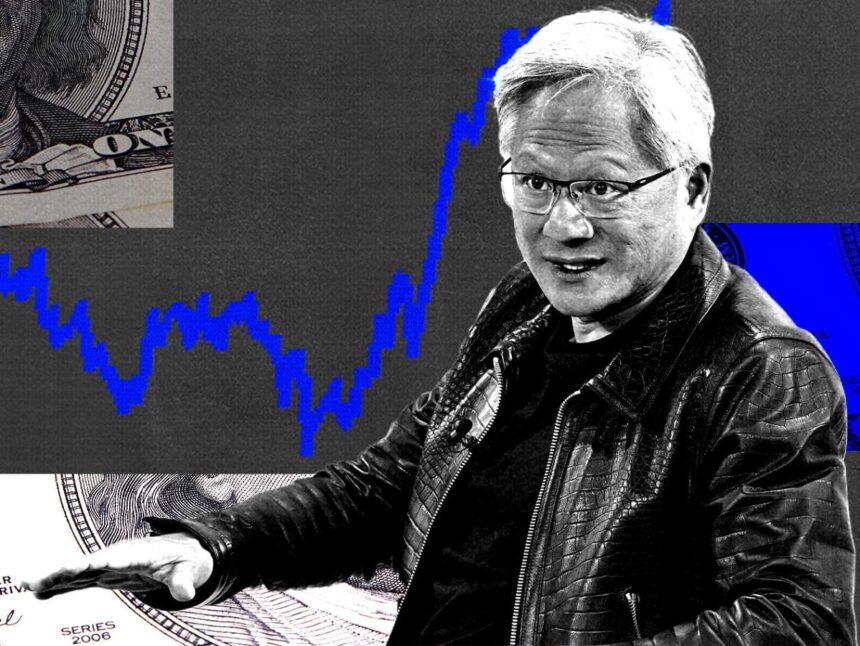

Last month, DeepSeek’s debut caused some anxiety among investors, as it suggested that data centers might not require as much computing power as initially anticipated. This raised doubts about the potential impact on Nvidia’s GPU sales. However, Nvidia’s CEO, Jensen Huang, has reassured stakeholders that DeepSeek’s efficiency gains will only accelerate the adoption and advancement of AI technology.

Analysts are optimistic about Nvidia’s performance, with expectations of revenue growth by 73% to $38.2 billion compared to the previous year’s revenue of $20 billion. Mizuho analysts anticipate some “growing pains” in the upcoming quarter, but are hopeful for a strong Blackwell ramp in the second half of the year.

Wedbush analysts are looking for another impressive performance from Nvidia, with a focus on the demand drivers from Blackwell and AI Capex. Bank of America analysts also expect Nvidia to exceed analyst estimates, with a surge in data center revenue for the calendar year 2025.

Looking ahead, analysts are excited about Nvidia’s upcoming GTC conference in March, where the focus is expected to shift towards its next-generation products, including the Rubin GPU and solutions for autonomous robots. Overall, analysts are confident in Nvidia’s ability to meet revenue expectations and raise guidance, thanks to the significant ramp-up in Blackwell GPU shipments.

Nvidia has successfully navigated recent supply-chain challenges and concerns about hyperscaler demand, as indicated by its stock price recovering from DeepSeek-related losses. With initial shipments to key customers underway and increased capital spending from major tech companies, Nvidia’s near-term sales outlook appears promising.

Encouragingly, analysts believe that Nvidia’s profit margins could improve in the second half of the year, returning to the mid-70s after a decline due to the Blackwell production ramp. As Nvidia continues to innovate and adapt to market dynamics, investors are eagerly anticipating the company’s performance in the coming quarters.

This rewritten article seamlessly integrates the original HTML tags, headings, and key points into a WordPress platform, providing a unique and informative perspective on Nvidia’s upcoming earnings report.