entertainment production.”

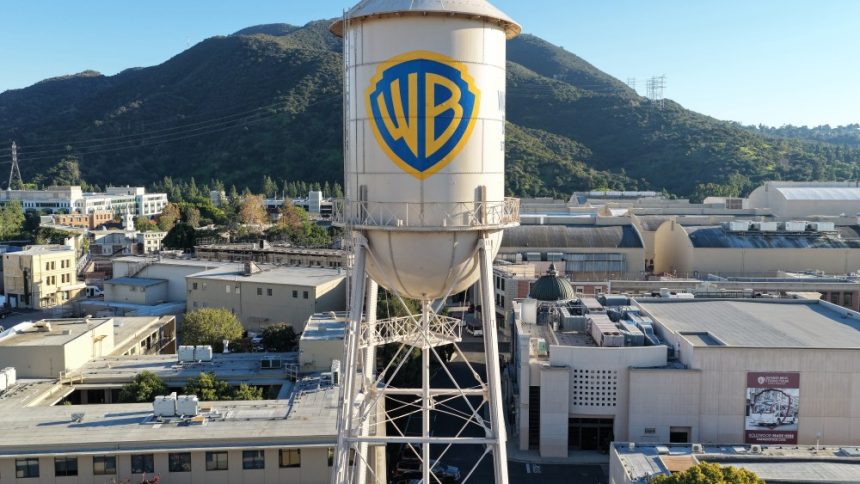

With the stakes high and tensions rising, the battle for Warner Bros. Discovery is heating up. As Paramount Skydance tries to outbid Netflix for control of the entertainment giant, the pressure is on for David Ellison to make a decision. Will he raise his offer to over $31 per share, as Warner Bros. Discovery is demanding?

The M&A jousting between Paramount Skydance and Warner Bros. Discovery has been intense, with multiple offers and counteroffers flying back and forth. Now, as the two companies enter the final rounds of negotiations, the focus is on whether Paramount will increase its bid to secure the deal.

Warner Bros. Discovery has set a date for a special meeting of shareholders to vote on the proposed $83 billion deal with Netflix, but the board is still open to discussions with Paramount. However, the board continues to recommend in favor of the Netflix merger and advises shareholders to reject Paramount’s latest offer.

In response to Paramount’s upgraded offer, Warner Bros. Discovery has engaged in discussions with the company to address unresolved issues and clarify terms. Paramount has indicated that it may be willing to raise its offer to $31 per share, but Warner Bros. Discovery is seeking further clarification on this point.

While the negotiations continue, Netflix retains its matching rights under the merger agreement, giving the streaming giant the opportunity to counter any new offers from Paramount. Netflix remains confident in its deal with Warner Bros. Discovery and emphasizes the value and certainty it provides to shareholders.

Warner Bros. Discovery CEO David Zaslav and board chairman Samuel Di Piazza Jr. are focused on maximizing value for shareholders and ensuring a smooth transition for the company. They are working closely with Paramount to determine if a superior offer can be reached, but the board remains committed to the Netflix merger as the best path forward.

As the deadline for a decision approaches, all eyes are on David Ellison and Paramount Skydance. Will they meet Warner Bros. Discovery’s demands and raise their bid to secure the deal, or will Netflix emerge victorious in the battle for control of the entertainment industry powerhouse? The future of Warner Bros. Discovery hangs in the balance, and the stakes have never been higher. Matheson

Lead Independent Director

Warner Bros. Discovery Inc.

February 16, 2026

The industry is abuzz with the news of Netflix’s proposed acquisition of Warner Bros.’s film and TV studios, HBO and HBO Max, and WBD’s games division. This move comes as part of Netflix’s strategy to increase its production capacity and drive long-term growth in the industry. The all-cash offer, valued at $27.75 per share, is seen as a bold move by Netflix in the face of competition from Paramount’s hostile takeover campaign.

Paramount, on the other hand, has made an amended offer with an enterprise value of about $108 billion, fully financed by equity commitments and debt financing from various sources. The offer includes backing from sovereign wealth funds of Saudi Arabia, Qatar, and Abu Dhabi. However, WBD’s Board of Directors remains committed to the Netflix transaction, citing its superior value for shareholders and strategic benefits.

WBD’s special shareholders meeting to vote on the Netflix pact is scheduled for March 20, 2026, with shareholders of record entitled to vote. Despite Paramount’s revised offer, WBD’s Board has not deemed it superior to the Netflix merger and remains focused on delivering value to its shareholders through the agreed-upon transaction.

In a letter to Paramount Skydance’s board, WBD’s Lead Independent Director, Samuel A. Matheson, expressed the Board’s commitment to securing a superior transaction for shareholders. The letter acknowledged Paramount’s willingness to address concerns but emphasized that the Netflix deal offers a high degree of certainty with minimal risk. WBD has sought a best and final proposal from Paramount, allowing for engagement until February 23 to clarify terms.

The industry awaits further developments as Netflix and Paramount vie for control of Warner Bros.’s assets. The outcome of these negotiations will have a significant impact on the future landscape of the entertainment industry, with implications for production capacity, investments, and long-term growth strategies. As the battle for industry dominance continues, all eyes are on the key players and their strategic moves in this high-stakes game. As the Board Chair of WBD, I am pleased to provide an update on the recent changes to the transaction agreements with PSKY. These changes reflect a collaborative effort to align the terms of the agreement with the interests of both parties involved. Below is a detailed summary of the key modifications made to the transaction agreements:

1. Refinancing and Junior Lien Notes: PSKY will now bear expenses related to any junior notes liability management exercise or pay a $1.5 billion financing fee to WBD by December 30, 2026. This change ensures a fair distribution of costs and aligns with industry standards.

2. Bridge Refinancing: PSKY’s consent will no longer be required for WBD’s bridge refinancing, providing more flexibility in securing financing. The terms of the refinancing, including the tenor and callability of the bonds and loans, have been optimized to benefit both parties.

3. Material Adverse Effect: The definition of “Company Material Adverse Effect” now excludes effects attributable to WBD’s Global Linear Networks business, enhancing closing certainty. This change addresses concerns raised by PSKY and ensures a smooth transition.

4. Equity Cure to Support Debt: Additional equity will be funded if the transaction faces closing uncertainty due to unavailable debt financing. This provision reinforces the commitment to completing the transaction and mitigates risks associated with high leverage.

5. Interim Operating Covenants: The interim operating covenants have been streamlined to allow WBD to operate its business without requiring consent from PSKY. This change eliminates unnecessary hurdles and promotes a seamless transition.

6. Equity Financing Certainty: Clarity and certainty of funding obligations have been emphasized in the revised equity documents, ensuring a smooth and efficient funding process at closing.

7. Equity Syndication: WBD will now receive full information regarding any equity syndication and consent will be required for syndications that may impact regulatory approvals or delay closing. This change enhances transparency and aligns with best practices in equity financing.

These modifications reflect our commitment to a successful transaction with PSKY and demonstrate our dedication to achieving a mutually beneficial outcome. We look forward to finalizing the agreements and moving forward with the transaction.