Warren Buffett to Address Tariffs and Market Turmoil at Berkshire Hathaway’s Annual Shareholder Meeting

Warren Buffett, the 94-year-old investment legend, will break his silence on tariffs and recent market turmoil when he kicks off Berkshire Hathaway’s annual shareholder meeting on Saturday. Tens of thousands of shareholders will gather in Omaha, Nebraska for the event, known as the “Woodstock for Capitalists.” This year marks the 60th anniversary of Buffett leading the company, and it is the second meeting without his long-time partner, Charlie Munger, who passed away in late 2023.

The meeting comes at a time of uncertainty in the markets, following President Trump’s imposition of high tariffs on imports. Wall Street economists are warning of a possible recession as economic indicators show signs of weakness. Investors are eagerly awaiting Buffett’s insights, as Berkshire Hathaway owns a diverse range of businesses that are directly impacted by economic conditions.

Berkshire has been selling more stocks than buying for the past nine quarters, offloading over $134 billion worth in 2024. This selling spree has boosted Berkshire’s cash reserves to a record $334.2 billion by December. Investors are eager to know if Buffett used the market downturn to make new investments and if he remains confident in the U.S. economy despite the tariff uncertainties.

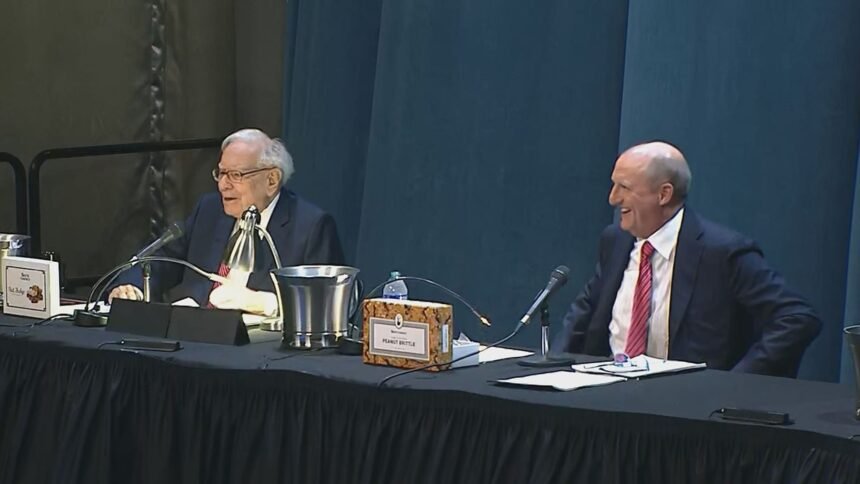

Buffett’s actions are closely watched by investors, who see him as a “north star” of value investing. The annual meeting will feature a question-and-answer panel with Buffett, his designated successor Greg Abel, and Berkshire’s insurance chief Ajit Jain. The event will be broadcast on CNBC and webcast in English and Mandarin.

Shareholders are particularly interested in Buffett’s decision to reduce Berkshire’s stake in Apple. After selling shares for four consecutive quarters, the holding has remained steady at 300 million shares since September. Buffett had cited tax reasons for the sales in the past, but investors are eager to hear his updated rationale, especially in light of changing political and economic conditions.

The first-quarter earnings report, to be released on Saturday, will provide insights into Berkshire’s top equity holdings, shedding light on any adjustments to the Apple stake. The meeting promises to be a crucial event for investors seeking guidance on navigating the current economic challenges and uncertainties.