Lars Svensson and the Target the Forecast Approach in Monetary Policy

In a recent discussion, Lars Svensson emphasized the importance of monetary policymakers targeting the forecast in order to achieve on-target inflation. This approach involves setting policy positions that are expected to lead to the desired inflation rate.

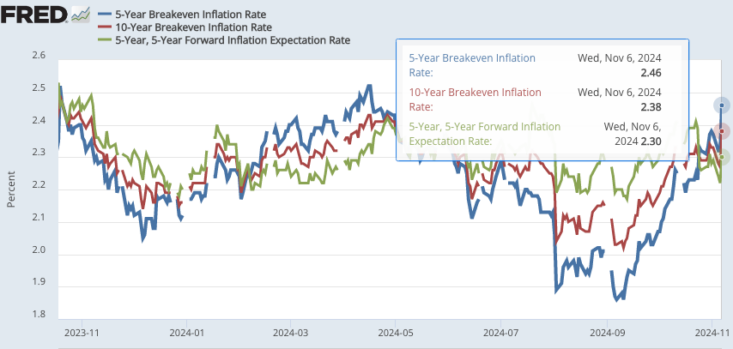

At the beginning of 2024, concerns arose due to some high inflation readings, sparking worries about the possibility of not achieving a soft landing. However, inflation gradually eased throughout the year, prompting the Federal Reserve to start cutting interest rates in September. Despite these efforts, there has been a recent uptick in 5-year inflation breakevens, reaching as high as 2.46%. While this measure is based on the CPI, which tends to run slightly higher than the Fed’s target PCE index, it still indicates expectations of inflation remaining above the 2% target set by the Fed.

As the Fed convenes today to discuss monetary policy, all eyes are on how they will respond to the recent surge in TIPS spreads. If they were to follow Svensson’s advice of targeting the forecast, one might expect a tightening of monetary policy.

Another approach to handling this situation is through a NGDP futures targeting regime. Given current market conditions, it is likely that investors would take long positions on NGDP futures, potentially putting the Fed in a precarious position if NGDP growth exceeds the target. This could lead to significant losses for the Fed, prompting them to take action to restore market confidence.

There are speculations that public discontent over inflation played a significant role in the recent election outcome. The reaction of the bond market to the election results further underscores this concern. It raises questions about how the media portrayed the market response and whether inflation should be a focal point of public discourse.

Ultimately, it is essential to avoid making hasty judgments based solely on changes in inflation rates. Instead, a comprehensive analysis of economic indicators and market trends is necessary to make informed decisions.

On a related note, Alex Tabarrok’s recent post on prediction markets offers valuable insights that extend beyond election predictions, highlighting the importance of market forecasts in shaping policy decisions.