Forms W-2 and W-4 are essential documents that play a crucial role in your tax obligations and filings. Understanding the differences between these forms is key to managing your finances effectively.

The W-2, also known as the Wage and Tax Statement, is a document that provides a summary of your earnings and taxes withheld by your employer throughout the year. It includes important information such as total wages, tips, and other compensation, as well as details on Social Security and Medicare taxes withheld. Employers are required to file a W-2 for each employee who earned $600 or more or had any income taxes withheld, regardless of their earnings.

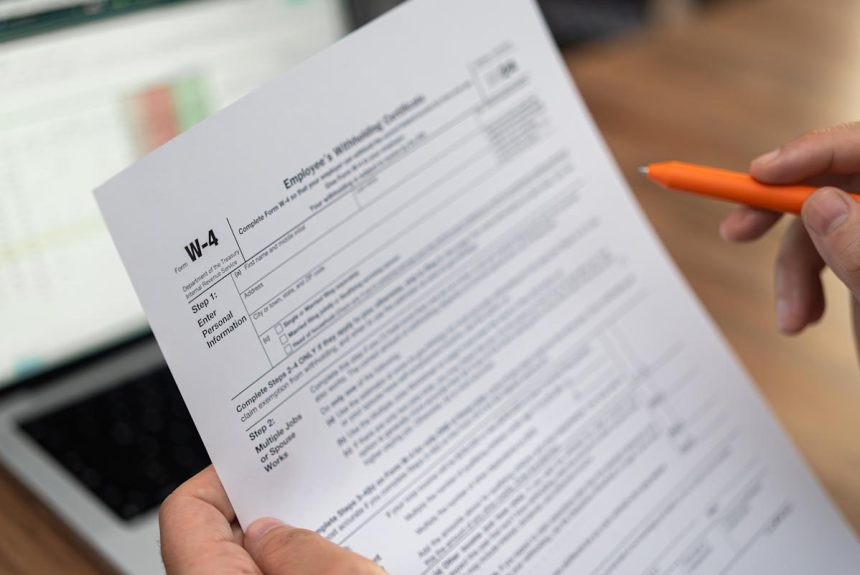

On the other hand, the W-4, or Employee’s Withholding Certificate, is a form that allows you to specify the amount of income taxes you want withheld from your paychecks. By providing information such as your tax filing status, credits, and deductions, you can adjust your withholdings to either increase or decrease the amount of taxes taken out of your pay. Higher withholdings result in a lower paycheck but potentially lower tax liability or a refund, while lower withholdings mean more take-home pay but could lead to a tax bill at the end of the year.

While employers are responsible for filing W-2 forms with the IRS by the deadline, employees must complete and submit a W-4 to their employer, typically through HR. It is important to update your W-4 whenever you start a new job or experience a life event that affects your financial situation, such as getting married or having a child.

When it comes to tax filings, you will need your W-2 to complete your income tax return, which is usually due by April 15th. This form provides the necessary information to determine your tax liability or potential refund. Employers are required to provide employees with their W-2 by January 31st, giving you ample time to file your taxes accurately.

In summary, while the W-2 summarizes your earnings and taxes paid for the year, the W-4 allows you to control the amount of taxes withheld from your paychecks. By understanding the purpose and importance of these forms, you can effectively manage your tax obligations and financial goals.