Tesla’s production ramp, including Cybercabs, must be supported by regulatory approvals. The company is likely to have a stronger second half in 2026 than its first. This could be the year that Tesla finally delivers on its unsupervised full self-driving and robotaxi aims.

Tesla’s management described 2025 as the “year of the Y,” but what will define 2026? One way to describe it could be a year when the chips went all in. The roadmap was set during the third-quarter earnings call, and Tesla is betting big on full self-driving (FSD) and robotaxis. It’s likely to be a second-half-weighted year for the company, so investors need to be patient through the year.

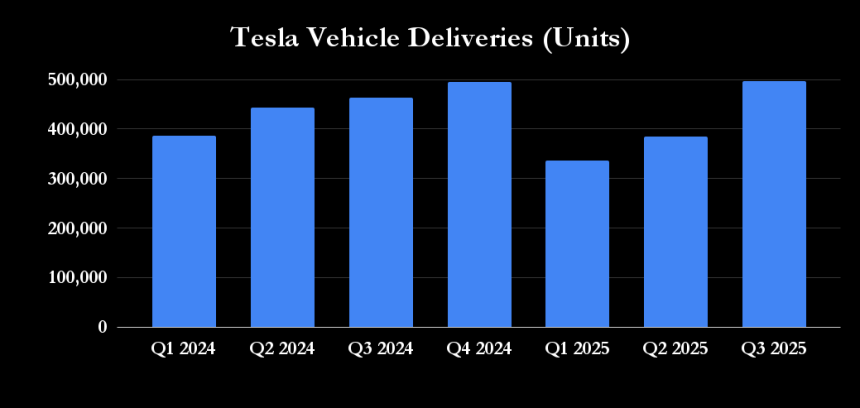

Tesla will release its fourth-quarter earnings in early 2026, and they are likely to show a sequential decline in electric vehicle (EV) deliveries, which could extend into the second quarter. The pull-forward in deliveries in the U.S. third quarter, driven by the expiration of the federal EV tax credit at the end of September, will lead to slowing sales in the fourth quarter. As such, Tesla’s overall sales may decline sequentially in the fourth quarter of 2025 and the first quarter of 2026 before returning to growth from the second quarter onwards.

Furthermore, CFO Vaibhav Taneja has informed investors that Tesla plans to increase capital spending substantially in 2026 to support ramping up EV production and invest in Tesla’s AI initiatives, including the Optimus robot. CEO Elon Musk aims to have the third generation of the Optimus robot in the first quarter of 2026.

Musk has reiterated the determination to ramp production, with a focus on the dedicated robotaxi, Cybercab, which will be the single biggest expansion in production starting in the second quarter of 2026. The production and capital spending ramp up, along with the focus on Cybercabs, demonstrate Musk’s confidence in the ongoing development of Tesla’s robotaxi rollout and unsupervised FSD.

In addition, Tesla is hoping for regulatory approvals for its FSD in Europe in 2026, which could open up new markets and boost EV sales. If all goes to plan, Tesla could end the year with a strong growth mode in the robotaxi rollout, backed by Cybercab deployment and FSD growth in Europe. Tesla’s EV sales could also receive a boost with more releases of stripped-down versions of its Y and 3 models.

However, there are risks involved if Tesla doesn’t achieve unsupervised robotaxi and FSD approvals in a timely fashion. The year 2026 is an all-in bet on FSD, and the outcome will depend on Tesla and regulatory bodies delivering on their promises.

Overall, 2026 looks to be a pivotal year for Tesla as it pushes forward with its ambitious goals for FSD and robotaxis. Investors will need to stay tuned to see how the year unfolds for the electric vehicle giant.