The iShares MSCI Global Silver and Metals Miners ETF (NYSEMKT:SLVP) and VanEck Gold Miners ETF (NYSEMKT:GDX) are both popular choices for investors looking to gain exposure to global mining stocks. While SLVP focuses on silver and diversified metals, GDX specifically targets gold miners. Each ETF offers unique benefits and features that appeal to different types of investors.

In terms of cost, SLVP has a lower expense ratio of 0.39% compared to GDX’s 0.51%. Additionally, SLVP boasts a higher dividend yield of 1.5% compared to GDX’s 0.6%, making it an attractive option for income-focused investors. However, GDX has a larger asset base of $33.5 billion compared to SLVP’s $1.3 billion, offering greater liquidity and scale.

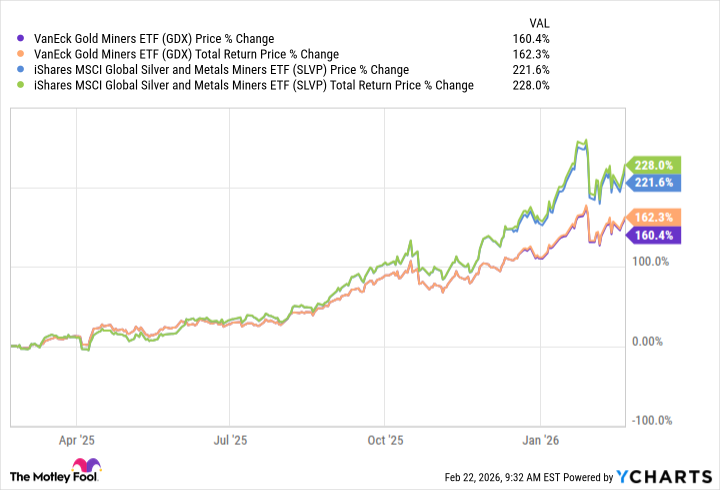

When it comes to performance, SLVP has delivered a 1-year total return of 228%, outperforming GDX’s return of 162.3%. SLVP also has a higher beta of 0.63 compared to GDX’s 0.41, indicating higher price volatility relative to the S&P 500.

In terms of portfolio makeup, GDX holds 55 global gold mining stocks, with top positions in companies like Agnico Eagle Mines, Newmont Corp, and Barrick Mining Corp. On the other hand, SLVP holds 30 companies with a clear tilt towards silver, including top holdings like Hecla Mining, Indust Penoles, and Fresnillo Plc.

For investors seeking exposure to precious metals, the choice between SLVP and GDX ultimately depends on whether they prefer silver or gold. GDX is a solid option for investing in gold mining stocks without the hassle of analyzing individual companies, offering superior liquidity and diversification within the industry. On the other hand, SLVP provides exposure to top-tier global silver mining companies at a lower cost and with a higher dividend yield.

In conclusion, both SLVP and GDX have their own unique strengths and characteristics that cater to different investment preferences. Investors may consider allocating funds to both ETFs for a balanced exposure to precious metals. Ultimately, the decision between SLVP and GDX will depend on individual investment goals and preferences.