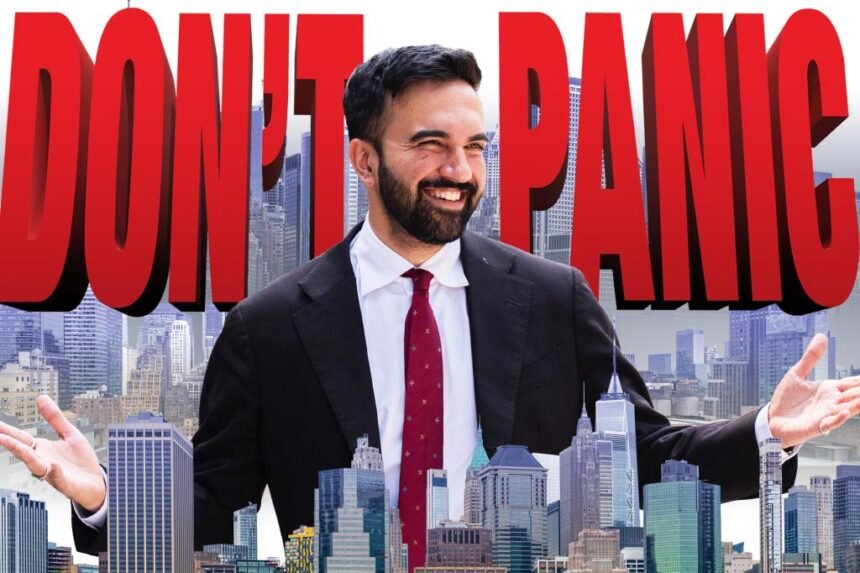

There is speculation that Zohran Mamdani, a socialist with limited private sector experience, could become the mayor of New York City. This might concern investors who own tax-free municipal bonds issued by the city. However, there are reasons to consider a long-term investment strategy even if Mamdani assumes office.

While municipal bonds, or munis, may not receive the same attention as stocks in the media, they offer significant tax advantages. They are triple-tax free, exempt from city, state, and federal taxes if issued by the city or town where you reside.

Despite Mamdani’s proposed spending plans and tax policies, the security of NYC bonds is not solely in his hands. General obligation bonds and Transitional Finance Authority debt have priority claims on tax revenues, safeguarded by state law. Changing this order would require legislative action and could hinder the city’s access to the market.

If Mamdani’s policies lead to lower bond ratings and prices, it could present a buying opportunity for muni investors. Holding onto bonds until maturity ensures a steady income stream, especially in a high-tax environment like NYC.

While Mamdani’s election could introduce uncertainties, current bondholders should not panic. The structural protections in place and the demand for NYC bonds may mitigate potential risks associated with his administration.