The $82.7 billion agreement for Netflix to acquire Warner Bros. and HBO Max was finalized after intense negotiations conducted through phone calls, emails, and text messages. The deal was sealed around 10 p.m. ET, with executives and legal teams from both companies spread across different locations.

One of the final hurdles in securing the agreement was Warner Bros. Discovery’s insistence on a record-setting $5.8 billion breakup fee in case of any resistance to the deal. Despite opposition from unions, consumer watchdogs, and politicians, the deal proceeded.

The acquisition by Netflix of Warner Bros. and HBO Max mirrors the AOL-Time Warner transaction in 2001, but with significant differences. Netflix’s strong balance sheet and consistent performance made it a more appealing buyer compared to other contenders like Paramount Skydance and Comcast.

The deal faced scrutiny from various quarters, with concerns raised about the potential monopoly power of the enlarged company. Netflix and Warner Bros. emphasized minimal overlap between their operations and their intention to maintain HBO Max and Warner Bros. as separate entities under the Netflix umbrella.

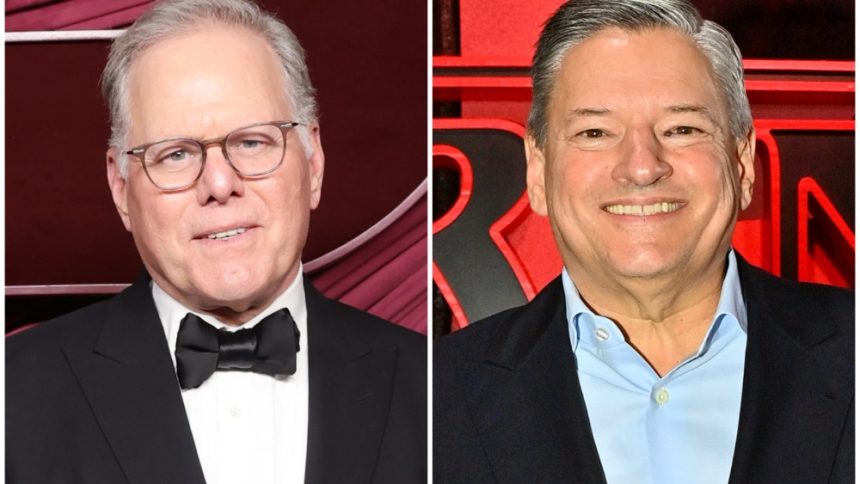

While the merger is expected to face a long regulatory process, Netflix and Warner Bros. executives are confident about the benefits of the deal. Warner Bros. Discovery CEO David Zaslav is focused on ensuring a smooth transition and delivering a healthy Warner Bros. and HBO Max to Netflix co-CEOs Ted Sarandos and Greg Peters.

If the deal goes through as planned, Zaslav will step down as CEO but stand to gain financially, along with other senior executives from Warner Bros. and HBO. The integration of the two companies under Netflix’s leadership signifies a significant shift in the entertainment industry landscape.