New York City Mayoral Candidate Proposes Eliminating Property Tax Exemptions for Columbia University

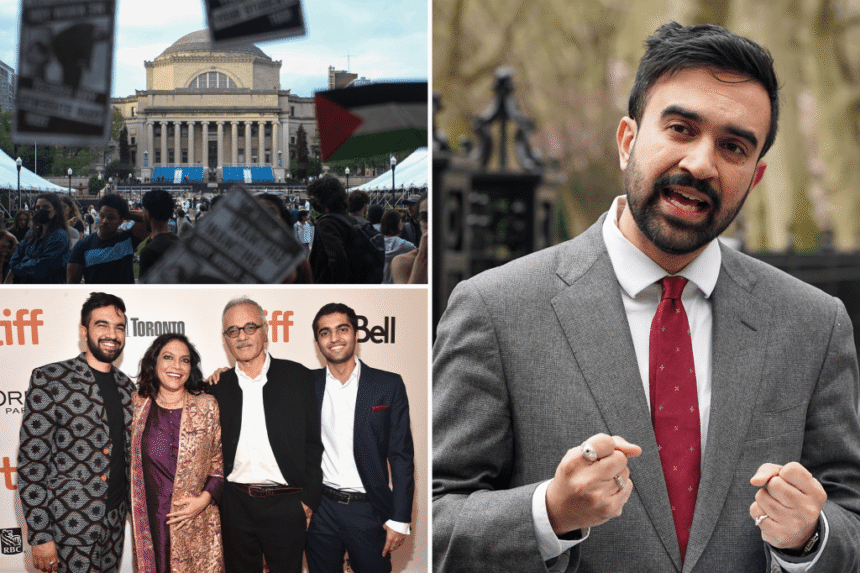

Zohran Mamdani, a Democratic socialist state Assemblyman and New York City mayoral candidate, has put forward a proposal to abolish hundreds of millions of dollars in yearly property tax exemptions for Columbia University. Interestingly, Mamdani and his family have been beneficiaries of these tax breaks for years as tenants of an apartment complex owned by the prestigious Ivy League institution.

The legislation proposed by Mamdani aims to significantly alter or repeal real property tax exemptions for private institutions of higher education. In New York City, private universities receive annual exemptions totaling $659 million, with Columbia University and New York University accounting for over $300 million combined.

Columbia University, a tax-exempt nonprofit organization, is one of the largest private property owners in the city. The institution owns 150 buildings that provide housing to thousands of faculty, staff, and students. Tenants of Columbia-owned properties often benefit from below-market rents due to the tax breaks enjoyed by the university.

One of the properties owned by Columbia is a 38-unit apartment complex on Riverside Drive exclusively reserved for faculty and staff. Mahmood Mamdani, Zohran’s father and Columbia University professor, has been a tenant at this complex for 25 years, with Zohran having grown up in the building.

Despite criticisms of hypocrisy leveled against Mamdani for proposing to eliminate tax breaks that his family has benefited from, he remains steadfast in his stance. He argues that institutions like Columbia and NYU have expanded beyond their original mission and should pay their fair share of property taxes.

Mamdani’s proposal has garnered support from various quarters, including President Trump, with progressives and conservatives alike questioning the fairness and necessity of these tax exemptions for universities. The legislation seeks to redistribute the tax revenue to the City University of New York, the public university system in New York City.

While the debate over property tax exemptions continues, Mamdani’s bill has sparked a broader discussion about the role of private universities in the city’s tax system and the allocation of resources for public education.