The decline of the Detroit auto industry is a poignant tale of a once-thriving city now facing significant challenges in the global market it once dominated. Detroit, known for its innovative automobile manufacturing, is now struggling to compete in an industry it helped build.

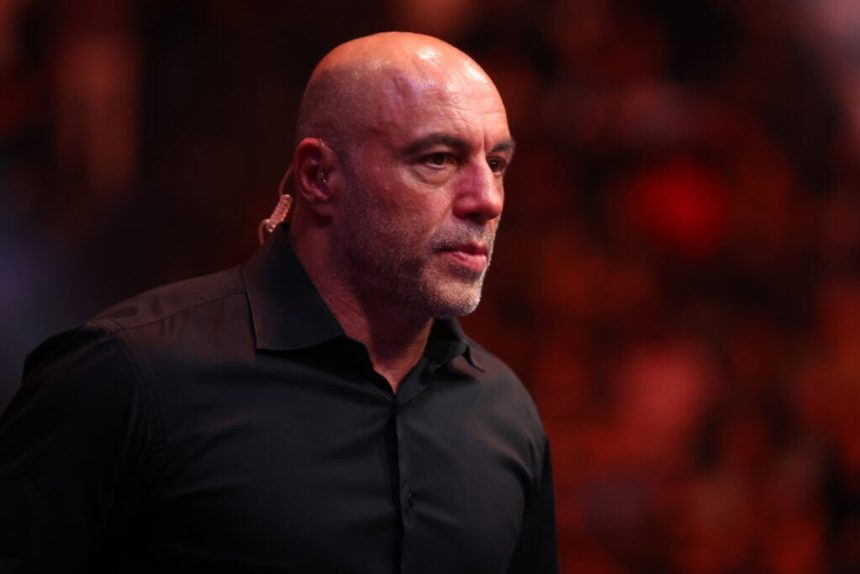

During a recent episode of “The Joe Rogan Experience” podcast, comedian Joe Rogan and Sen. Bernie Sanders discussed the downfall of Detroit. Rogan expressed his admiration for the cars produced by Detroit factories in their heyday and lamented the city’s current state as “disgusting.” He highlighted the abundance of abandoned buildings and the surreal sight of entire factories in disrepair, symbolizing the city’s drastic decline.

Major Detroit automakers, such as General Motors Co. and Ford Motor Co., are facing fierce competition from Chinese carmakers. Both companies have recently announced substantial writedowns tied to a shift away from electric vehicle (EV) investments towards gas-powered vehicles and hybrids, reflecting a changing market landscape.

Sanders attributed the decline of Detroit and other U.S. business hubs to major corporations moving jobs overseas to countries like China and Mexico to cut costs. This outsourcing of jobs has had a detrimental impact on American workers, leading to lower wages and diminished job opportunities.

The discussion also touched upon Michael Moore’s documentary “Roger & Me,” which delves into GM’s plant closures in Michigan and their devastating effects on local communities. Rogan praised the documentary for shedding light on the repercussions of corporations relocating factories without warning, leaving behind a trail of economic devastation in Detroit.

As the conversation highlighted the challenges facing the Detroit auto industry, it underscored the importance of diversifying investment portfolios. Platforms like Masterworks offer investors the opportunity to diversify their portfolios with long-term art appreciation, providing an alternative asset class with potential for steady returns.

In conclusion, the fall of the Detroit auto industry serves as a cautionary tale of the consequences of corporate greed and the importance of adapting to evolving market trends. By learning from Detroit’s struggles, investors can make informed decisions to safeguard their financial interests and navigate the ever-changing economic landscape.