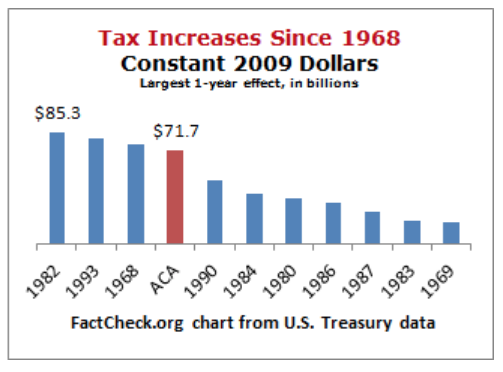

The recently introduced auto tariffs are projected to generate approximately $100 billion annually in revenue. How does this figure stack up against previous significant tax increases?

According to the Tax Foundation, the prior record stood at $76.8 billion, a tax hike implemented in 2011 to fund the Affordable Care Act (commonly known as Obamacare).

In real dollar terms, while the auto tariffs might not eclipse some of the historical tax hikes, they still represent one of the most significant tax increases since 1968. (For context, the Consumer Price Index has surged nearly 50% since 2009.)

With additional tariffs anticipated in the near future, the Trump administration’s tariff strategy could potentially be the largest tax hike in real terms ever. So, how do Democrats perceive this shift in federal tax policy, arguably one of the most significant changes in recent memory?

I took to the New York Times, which, as is often the case, featured a lengthy article filled with interviews. My particular interest lay in uncovering Democratic perspectives on the matter. Strangely, the article offered insights from several key political figures, yet not a single Democrat was included. In fact, besides Trump, the opinions came solely from Republicans.

You might argue that the NYT has a liberal bias, but surely, during Obama’s tax increase discussions, the “paper of record” managed to showcase some Republican viewpoints. Do the Democrats intend to overturn the auto tariffs once they regain power? What about Republican congress members? Shouldn’t we be informed about their stances?

While it’s certainly noteworthy that leaders from Canada, Mexico, and France oppose Trump’s tariffs, the reality is that the tax burden ultimately falls on American citizens. I would have appreciated some commentary from American politicians regarding their stance on this issue.

Here’s a brief legal overview:

The U.S. Constitution grants Congress the authority to “lay and collect Taxes, Duties, Imposts and Excises” (Article I, Section 8), which includes tariffs, and to regulate commerce with foreign nations.However, the President also possesses the power to impose tariffs, particularly through delegated authority and under specific conditions, such as national security threats or unfair trade practices.

I find myself grappling with the legal justifications for these tariffs. It’s difficult to fathom how Canada could be classified as a national security threat, especially given that President Trump negotiated a free trade agreement with Canada in 2020, which he later dubbed the best trade deal ever. The notion of “unfair trade practices” also seems to be a stretch.

Historically, the Supreme Court has often interpreted government powers quite broadly. While the “takings clause” stipulates that eminent domain should only apply to projects serving a “public use,” courts have ruled that almost anything a government designates as a public purpose can be considered as such. Perhaps this loose interpretation applies here as well.

It’s worth noting that the administration denies that military actions in Yemen constitute a “war,” yet simultaneously claims authority to deport Venezuelans under “war powers.” It appears that the definitions of war and conflict are rather elastic—migration equates to warfare, but bombing does not.

The crux of the matter is that we should not expect the Constitution to effectively limit the powers wielded by the U.S. government.

PS: It is anticipated that a significant tax cut will be enacted later this year, likely involving the extension of previous Trump tax cuts that were set to expire.