Guest post by Joel Gilbert

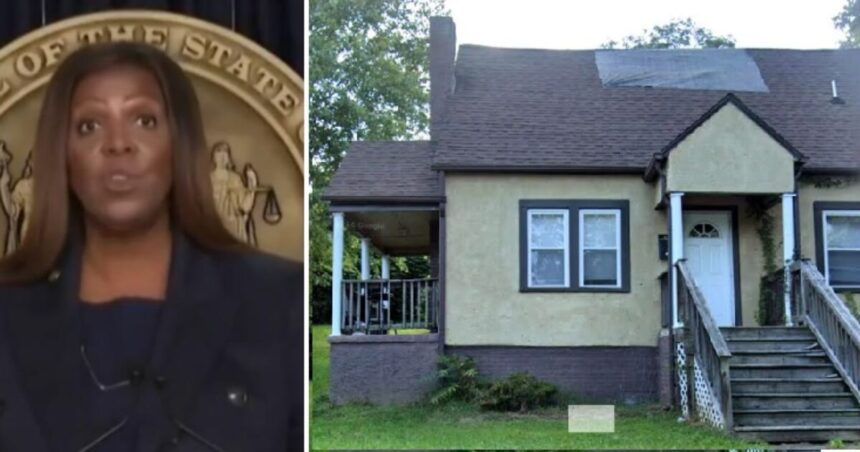

Recently, I explored a rather intriguing case involving Letitia James in the Gateway Pundit, highlighting some discrepancies in her claims regarding the number of apartment units in her Brooklyn building when seeking loans and refinancing.

James consistently informed banks and the federal government that her property located at 296 Lafayette Avenue consisted of merely four apartment units. However, the official Certificate of Occupancy for the building reveals a different story: it actually contains five units.

This misrepresentation is significant, as claiming only four units allowed James to qualify for lower interest residential rates. In contrast, properties with five or more units are classified under commercial rates, which are notably higher. Additionally, she managed to secure a government HAMP loan, which is typically off-limits to borrowers with more than four units.

Furthermore, Sam Antar has shed light on another incident via his website, White Collar Fraud, where James reportedly claimed that a property she purchased in Norfolk, Virginia, would serve as her primary residence—a designation that typically leads to more favorable loan terms from financial institutions.

Bill Pulte, the Director of the Federal Housing Finance Agency, has since forwarded a criminal referral to the U.S. Justice Department, citing concerns regarding Letitia James’s mortgage history.

Now, the focus is shifting towards potential insurance fraud.

This issue primarily pertains to James’s residency claim for a mortgage in Norfolk, Virginia. The classification of a home as owner-occupied versus non-owner-occupied significantly influences insurance rates.

Homes that are owner-occupied—essentially the primary residence of the homeowner—are generally deemed lower risk by insurers. They assume such homes are better maintained and monitored, which decreases the likelihood of issues like water damage, fire, or theft going unnoticed.

As a consequence, insurance premiums for owner-occupied properties are typically lower. These policies often come with standard coverage packages, such as HO-3 policies, covering the dwelling, personal property, liability, and loss of use.

Conversely, non-owner-occupied homes, which include rental properties, vacation homes, or vacant houses, are considered higher risk, and thus command steeper premiums. Landlords of rental properties require specialized insurance (often called DP-3 policies) that covers the dwelling, liability, and potential loss of rental income. Because tenants may not maintain the property as diligently as homeowners, the risk of damage increases, leading to higher insurance costs.

Vacant homes are regarded as even riskier due to the potential for vandalism, theft, and undetected damage. Such properties often need separate vacant home insurance, which comes with limited terms and elevated costs.

Ultimately, insurance companies base their rates on perceived risks, and whether or not a home is owner-occupied is a key element in that assessment.

In terms of Letitia James’s claims concerning her Brooklyn building, the distinctions in insurance policies for apartment buildings are quite pronounced based on the number of units. This is especially true between buildings with four or fewer units and those with five or more.

Properties with up to four units—such as duplexes, triplexes, or fourplexes—are typically classified as residential for insurance purposes. These buildings can often qualify for standard residential insurance policies, like a Dwelling Property (DP-3) policy or even a Homeowners (HO-3) policy if the owner occupies one of the units.

Such residential policies are straightforward, come with lower premiums, and usually include coverage for the building structure, liability, loss of rental income, and optional protection for items like appliances. Insurers view these properties as lower risk because they are smaller and often self-managed.

Conversely, buildings with five or more units are generally categorized as commercial properties, necessitating more expensive commercial property insurance policies. The greater number of tenants in these larger buildings results in increased maintenance needs and more complex liability exposure.

This means that commercial insurance policies are typically more comprehensive and customizable, covering the building itself, general liability, loss of rental income or business interruption, equipment breakdown, ordinance or law compliance, and even protection against crime or vandalism.

The underwriting process for these policies is more rigorous and may involve property inspections or detailed financial disclosures. Given the increased risk and broader coverage, premiums for commercial apartment insurance are generally much higher.

Often, properties of this magnitude are managed by professional firms rather than individual landlords. Understanding the difference between residential and commercial classifications is crucial for property owners to ensure appropriate coverage for their investments.

By misrepresenting both her residency status for the Norfolk home and the unit count in her Brooklyn apartment building, Letitia James may have crossed legal boundaries.

Intentionally providing false information to an insurer, especially during the claims process, can be classified as insurance fraud—a serious criminal offense.

Unlike minor oversights, intentional misrepresentation is viewed as a deliberate effort to deceive the insurance company for financial gain. The consequences of insurance fraud can be severe, leading to substantial fines, restitution ordered by a court, and potentially imprisonment, particularly in cases involving large claims or repeated offenses.

In many jurisdictions, insurance fraud is prosecuted as a felony, carrying long-term repercussions such as a permanent criminal record. Authorities take these matters seriously, and insurers actively investigate suspicious claims, frequently employing fraud detection units and industry databases.

A conviction for insurance fraud not only results in legal penalties but can also irreparably damage a person’s credibility and future insurability. As Ms. James often reminds us during her legal pursuits against Donald Trump, no one is above the law—not even Letitia James.

Joel Gilbert is a Los Angeles-based film producer and president of Highway 61 Entertainment. He can be found on Twitter: @JoelSGilbert.