President Trump’s Budget Bill Faces Opposition from GOP Fiscal Hawks

President Trump’s proposed budget bill, touted as a “big, beautiful bill,” hit a roadblock on Friday as it failed to advance out of committee due to opposition from GOP fiscal hawks. The bill was criticized for not doing enough to reduce the federal budget deficit.

Five Republicans, including Chip Roy of Texas and Ralph Norman of South Carolina, voted against moving the reconciliation measure out of the House Budget Committee, resulting in a 21-16 defeat.

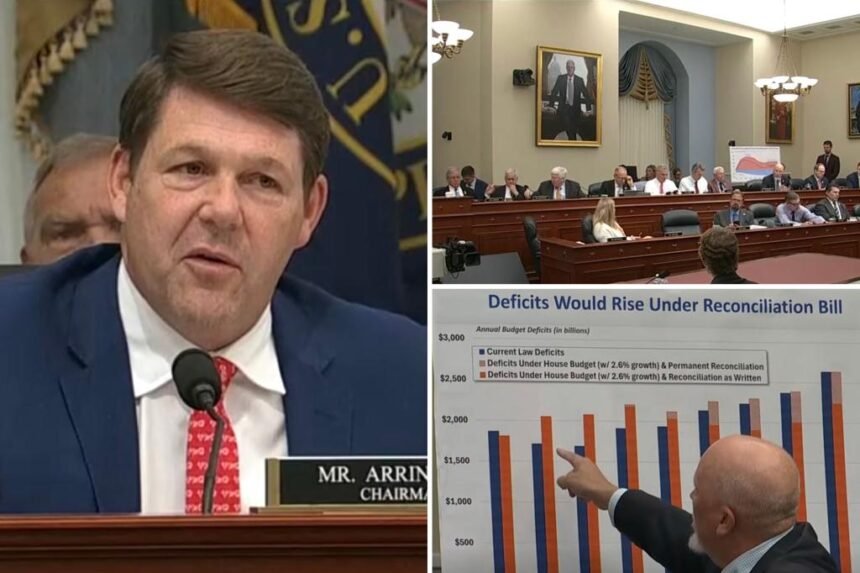

Committee Chairman Jodey Arrington (R-Texas) announced that further discussions on the bill would likely take place on Monday.

According to the nonpartisan Committee for a Responsible Federal Budget (CRFB), the bill could potentially lead to a $3.3 trillion deficit increase over the next decade if passed in its current form. The CRFB also estimated that making Trump’s 2017 tax cuts permanent could add $5.2 trillion to the deficit by 2034.

Republican members like Chip Roy expressed concerns about the bill’s impact on deficits, stating that it would burden future generations with debt. Others, like Ralph Norman, called for changes to Medicaid benefits and emergency services for non-citizens.

The bill faced criticism for backloaded savings and front-loaded spending, prompting calls for immediate reforms. Discussions on the bill were cut short on Friday as members acknowledged that more work needed to be done.

President Trump took to social media to urge Republicans to unite behind the bill, emphasizing its tax-cutting benefits and measures to restrict Medicaid access for illegal immigrants. The bill also aimed to address taxpayer spending on emergency medical services for illegal immigrants.

Despite the setbacks, House Speaker Mike Johnson expressed optimism about passing the bill, highlighting ongoing efforts to address concerns raised by fiscal hardliners and New York Republicans.

The bill’s fate remains uncertain as negotiations continue, with a focus on achieving deficit-neutral solutions and addressing key issues such as the SALT deduction cap.