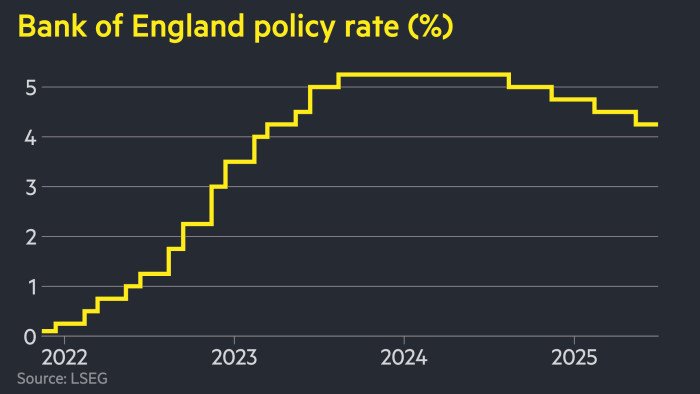

The Bank of England has decided to keep interest rates steady at 4.25 per cent, but hints at a possible cut in August due to a weakening job market. This decision comes after a quarter-point cut in May, which was influenced by concerns over President Donald Trump’s tariff policies. Governor Andrew Bailey stated that interest rates are still on a downward trend, despite the hold today.

The Monetary Policy Committee’s six-to-three vote reflects ongoing concerns about strong inflation and uncertainty caused by escalating conflicts between Israel and Iran. The committee is closely monitoring the impact of these factors on inflation, especially in light of the weak labor market.

Deputy governor Dave Ramsden, along with external MPC members Swati Dhingra and Alan Taylor, have called for an immediate further cut in rates to 4 per cent. This more dovish stance was unexpected by investors, with the MPC predicting a “significant slowing” in pay growth and hinting at a possible rate cut in August.

The UK’s GDP growth remains weak, according to the MPC, with businesses reporting negative hiring intentions and subdued employment growth. The latest labor market data suggests that the economy is weakening faster than anticipated, prompting concerns among economists.

Inflation remains a key concern, with consumer price inflation for May at 3.4 per cent, above the BoE’s 2 per cent target. The central bank expects inflation to remain around 3.5 per cent for the rest of the year, peaking at 3.7 per cent in September. The pound remained stable against the dollar following the MPC’s decision, with traders anticipating further rate cuts by the end of the year.

The BoE reiterated its commitment to a gradual and cautious approach to rate reductions, closely monitoring inflation expectations and economic uncertainties. As geopolitical tensions and energy costs rise, the central bank remains sensitive to these factors and their potential impact on the economy.

Overall, the decision to hold interest rates steady reflects the ongoing challenges facing the UK economy, with policymakers balancing the need to support growth while managing inflationary pressures. The BoE’s cautious approach to future rate cuts signals a willingness to adapt to changing economic conditions and uncertainties in the global environment.