The Lobbying Boom: Trump’s First Six Months Fueling a Cash Surge

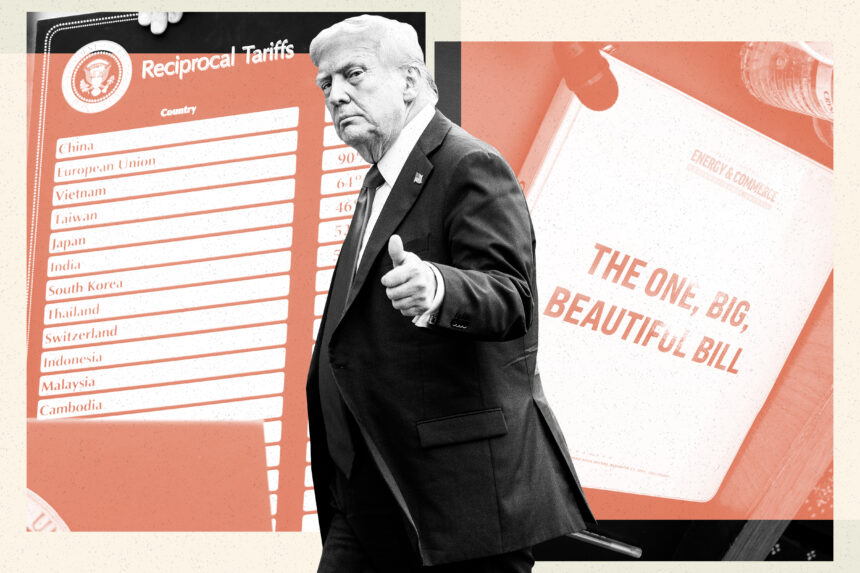

The initial half-year of President Donald Trump’s administration has unleashed a veritable goldmine for the lobbying sector, characterized by unprecedented demand for assistance in navigating the administration’s erratic policy announcements — or, more importantly, evading the pitfalls of the GOP’s expansive legislation.

This frenzy has birthed a new cadre of power brokers in what many have dubbed Trump’s swamp. Firms with close connections to the White House have rapidly ascended the ranks of lobbying firms in Washington, D.C., as revealed by a recent analysis from POLITICO based on the latest quarterly lobbying disclosures.

Leading the charge is Ballard Partners, helmed by Trump fundraiser Brian Ballard. This firm, which counts among its ranks former White House Chief of Staff Susie Wiles and Attorney General Pam Bondi, reported an astounding $20.6 million in lobbying revenues for the second quarter, thanks to clients like Palantir, American Express, TikTok, Ripple Labs, and UnitedHealth. This figure eclipses the firm’s Q2 earnings from the previous year by more than four times.

However, the financial windfall isn’t limited to a single firm; the entire lobbying industry is reaping the rewards, with both established and new players thriving. According to the analysis, only two of the top 20 firms by revenue reported a decline in their lobbying income compared to the same quarter last year. Notably, these figures exclude revenue from consulting or foreign agent work.

Rich Gold, who leads the public policy and regulation group at Holland & Knight, noted, “The number of people who feel they need representation at this point is huge, and we’re really just getting into sort of the day-to-day of governing.” His firm, which ranked fifth in K Street earnings last quarter with $13.8 million, welcomed 57 new clients in the first half of the year, marking a record intake for them.

Gold attributes the surge in business to the pervasive uncertainty enveloping corporations and their desire to mitigate political risk: “While specific legislation like the recently signed One Big Beautiful Bill Act has indeed spurred lobbying activity, the demand for political intelligence and advocacy in D.C. this year stretches well beyond any one law,” he explained.

Ballard’s impressive earnings have allowed it to surpass Brownstein Hyatt Farber Schreck, which had held the top spot in quarterly revenue rankings since 2021. Brownstein itself set a record with $18.5 million in lobbying revenues during Q2.

Competitors linked to Trump are also enjoying their share of the pie. Miller Strategies, operated by prominent GOP fundraiser Jeff Miller and staffed with several former Trump administration officials, garnered nearly $13 million in Q2 from clients like Zoom, OpenAI, Apple, Softbank, Crypto.com, and Blackstone—a remarkable 80 percent increase since the start of the year and quadruple its revenues from the same quarter last year.

Continental Strategy, which boasts former Trump appointee Carlos Trujillo and a former aide to Senator Marco Rubio, reported $6.5 million in lobbying revenues last quarter, placing it 15th among firms by lobbying revenue in Q2. This is a staggering leap from the mere $292,000 it reported in the same period last year.

Interestingly, a newcomer to the D.C. lobbying scene, North Carolina-based Checkmate Government Relations, which opened a D.C. office in December, brought in $4.5 million in lobbying fees in Q2—more than quadrupling its $910,000 revenue from earlier this year. Its president, Ches McDowell, is not only a hunting buddy of Donald Trump Jr. but also the brother of freshman Rep. Addison McDowell (R-N.C.). The firm has also recruited family members of top Trump campaign officials.

BGR Group, a bipartisan firm with a Republican tilt and alumni including Transportation Secretary Sean Duffy, reported its most successful quarter in its 35-year history, boasting $17.7 million in lobbying fees in Q2—a nearly 60 percent increase from the previous year.

Mercury Public Affairs also celebrated a successful quarter, bringing in almost $6.5 million from April to June, up from $3.2 million in Q2 of 2024. This firm has ties to Wiles, who co-chaired the operation before moving to the White House, and also employs former Trump advisor Bryan Lanza, who has attracted numerous new clients since the election.

On K Street, the all-Republican firm CGCN Group doubled its lobbying revenues year-over-year, while Michael Best Strategies, led by Trump’s first White House Chief of Staff Reince Priebus and Trump’s 2024 co-campaign manager Chris LaCivita, saw its Q2 lobbying earnings more than triple.

Lobbyists are optimistic that these prosperous times will continue, at least for the foreseeable future, even after the recent signing of the megabill. However, not all are convinced that this Trump-fueled lobbying renaissance will endure.

Gold remarked, “We’ve seen personality-driven firms rise and fall in the past. I suspect that will be the case here as well.” The ongoing disruptions in trade policy and a barrage of executive orders and presidential memoranda have emerged as significant drivers of lobbying activity this year.

“The beginning of any new administration is always a busy period,” added Karishma Page, a partner at K&L Gates. “I believe we are witnessing a high watermark.” K&L Gates experienced a 25 percent increase in lobbying revenue last quarter compared to the previous year, driven by vigorous activity on both sides of Pennsylvania Avenue.

Will Moschella, co-leader of the lobbying practice at Brownstein, noted, “There appears to be an insatiable appetite among clients for insights into the Trump administration.” He elaborated that many executive orders necessitate departments and agencies to submit policy proposals, creating a cascading effect of ongoing executive actions.

From an advocacy standpoint, the ongoing debate surrounding the Republicans’ vast reconciliation package this spring and summer is akin to “having your dessert,” as Gold put it. These negotiations have prompted lobbying from a wide array of stakeholders, including universities, business groups, hospitals, and the renewable energy sector.

Yet, the daily regulatory work at various agencies, which Gold aptly likens to “eating your spinach,” is just beginning to ramp up. Additionally, the uncertainty surrounding Trump’s tariff policies, along with essential legislation related to government funding and the reauthorization of national farm and defense policies, adds layers of complexity to the lobbying landscape.

These issues — while perhaps less glamorous than the latest trends in crypto or AI policy — have become focal points for increased client attention, particularly given Trump’s sweeping budget cuts across the nation and the recent recissions bill passed by Congress.

As Page argues, “There is a pressing need to substantiate the work of organizations that may be federal contractors or grantees.” This urgency extends to clients eager to sidestep the president’s wrath; as Monroe noted, “Initially, there was a sense that one could simply lay low and avoid attention. The past six months suggest that the best defense is a strong offense… telling your story; otherwise, you risk having it told for you.”