Federal Reserve Governor Stephen Miran Dissents from Rate Cut Decision

Stephen Miran, the newly-confirmed Federal Reserve Governor, made headlines by dissenting from the central bank’s decision to lower the federal funds rate by a quarter percentage point on Wednesday. Miran, who was confirmed by the Senate to the Fed Board of Governors on Monday, called for a more aggressive half-point cut instead.

During the Federal Open Market Committee’s statement, Miran was the lone dissenter, while Governors Michelle Bowman and Christopher Waller, who had previously dissented in favor of a quarter-point cut, aligned with Fed Chair Jerome Powell and the majority.

Chris Zaccarelli, chief investment officer at Northlight Asset Management, noted the interesting dynamics within the Fed, with Miran taking a more dovish stance compared to his colleagues. Miran’s dissent indicates a desire for deeper rate cuts compared to the rest of the board.

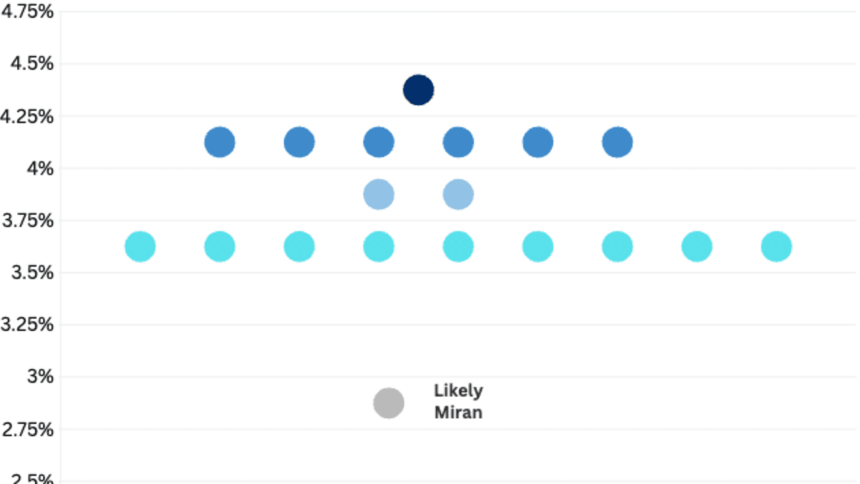

The Fed’s dot plot for 2025 reveals a wide range of opinions among FOMC participants, with some forecasting up to four rate cuts in 2026. Miran’s outlook stands out as particularly dovish, hinting at potential further rate reductions in the coming months.

Miran’s appointment by President Trump in August raised concerns about the Fed’s independence, as Trump has now nominated three of the seven board members. Miran’s presence on the board, filling the seat vacated by Adriana Kugler, has sparked speculation about the administration’s influence on monetary policy.

Despite the controversy surrounding Miran’s appointment, his dissenting voice brings a fresh perspective to the Fed’s decision-making process. As the central bank navigates uncertain economic conditions, Miran’s views could shape future monetary policy discussions.