California Lawmakers Approve Expansion of Film and TV Tax Incentive Program

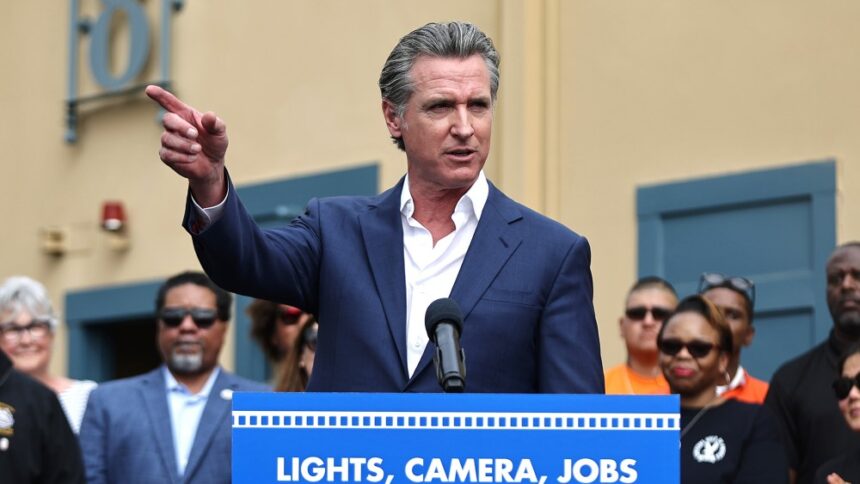

California lawmakers have reached an agreement to expand the state’s film and TV tax incentive program to $750 million annually, a significant increase from the previous $330 million budget. This decision marks a major victory for the entertainment industry and Governor Gavin Newsom.

The state Senate and Assembly leadership have endorsed Governor Newsom’s proposal for increased funding, which is more than double the current program budget. A vote is scheduled for Friday on a trailer bill to officially approve the expansion, as confirmed by multiple sources.

Governor Newsom initially proposed the funding increase in response to a sharp decline in film and TV production in the state. This initiative has been one of his top priorities in the current budget cycle. The precise funding level had been uncertain until this week when the terms of the budget agreement were finalized.

The additional funding is expected to boost the number of film jobs supported by the program by 40-50%, creating an estimated 4,400 to 5,500 new jobs, according to the California Film Commission.

In addition to the increased funding, legislators are also working on a companion bill, AB 1138, to enhance the program and make it more inclusive. The proposed bill will raise the tax credit for each project from 20% to 35%, with the potential to increase it further to 40% for productions filmed outside of Los Angeles.

Moreover, the bill will expand eligibility to include sitcoms, animation, and large-scale competition shows. Legislators have also incorporated new provisions aimed at benefiting low-income communities, such as a 2% bonus for productions that hire trainees from underrepresented communities.

The revised bill also requires productions to report the diversity of their employees by race, ethnicity, gender, ZIP code, and veteran status to promote geographic and demographic diversity in the industry. Additionally, the program will open up training opportunities to more nonprofits next year, with a focus on ensuring that trainees do not displace experienced workers.

Independent filmmakers outside of Los Angeles, represented by the Out of Zone Coalition, had advocated for a higher bonus for non-L.A. shoots but were unsuccessful in their efforts. The bill is expected to be approved by July 4 and will go into effect immediately.

Overall, the expansion of the film and TV tax incentive program in California is a significant step towards revitalizing the entertainment industry in the state and creating more opportunities for diverse and underrepresented communities.