Central Huijin, a subsidiary of China’s sovereign wealth fund, has been a crucial player in supporting the country’s financial system for the past two decades. Its interventions, ranging from recapitalizing rural banks to bolstering the stock market, have become increasingly prominent in the last year.

In 2024, Central Huijin’s holdings of exchange traded funds surged to over Rmb1tn ($140bn), a significant increase from the previous year. This surge was a result of government-mandated stimulus measures aimed at stimulating the economy. As China aims to build larger financial institutions to navigate economic uncertainties, Central Huijin’s role has become even more crucial.

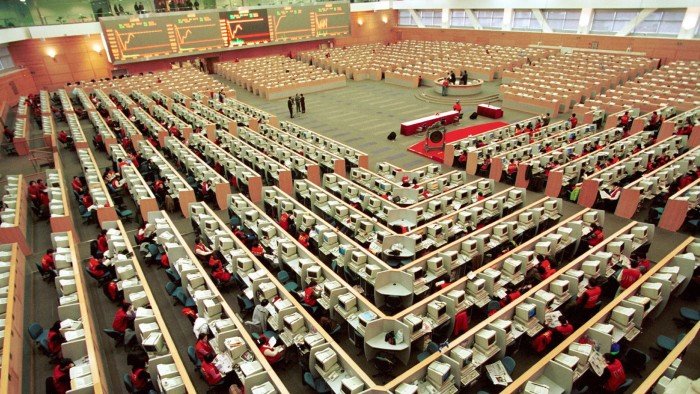

During the height of the trade war with the US in April, Central Huijin publicly declared its support for the markets, positioning itself as a member of the “national team” of state-backed investors in China. This marked a shift in its role, signaling a more active involvement in stabilizing the financial sector.

With a portfolio that includes major lenders like ICBC and strategic stakes in key financial institutions, Central Huijin plays a vital role in reshaping China’s financial landscape. Led by Zhang Qingsong, a seasoned central banker with extensive experience in China’s financial system, the fund has expanded its reach across the financial sector.

In a strategic move, the Ministry of Finance transferred controlling stakes in China’s top bad-debt managers to Central Huijin last year. With total assets under management amounting to $1.1tn, the fund’s influence extends to a vast portfolio of state financial institutions, totaling at least $29tn.

Central Huijin’s focus has shifted towards increasing its holdings of exchange traded funds, particularly those tracking major indices, to avoid issues associated with single-stock purchases. This shift was intensified following external factors like tariffs imposed by the US, prompting the fund to step up ETF purchases.

As China consolidates its financial sector, Central Huijin’s role in facilitating mergers and expediting approval processes has become more pronounced. Its activities align with the government’s push for higher dividends and reduced mutual fund fees, signaling a coordinated effort to streamline the financial system.

While intervention funds like Central Huijin typically exit the market after a few years, the sheer size of its recent purchases may prolong its presence. With A-share markets gaining strategic importance and valuations remaining low, the fund and authorities may hold positions for decades to come, ensuring stability and growth in China’s financial sector.