GlobalFoundries Inc. (NASDAQ:GFS) has been identified among the worst-performing data center stocks in 2025. On September 23, during its Technology Summit held in Shanghai, the company announced a strategic partnership with Egis Technology. This collaboration is designed to advance smart sensing solutions and aims to develop direct time-of-flight (dToF) sensors, leveraging GF’s 55nm platform for applications in mobile, Internet of Things (IoT), and automotive sectors.

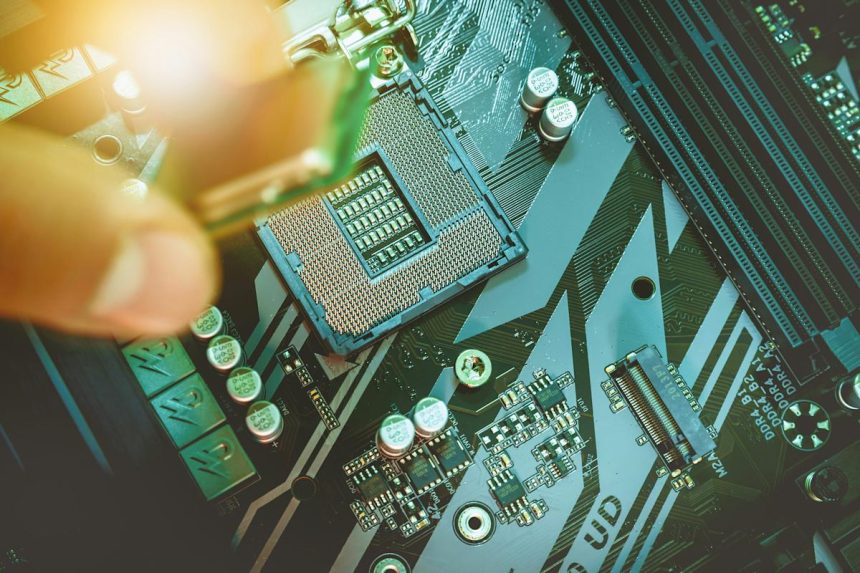

Photo by Jeshoots.com on Unsplash

The new sensors will utilize GlobalFoundries’ innovative front-side-illuminated SPAD (single-photon avalanche diode) technology, providing enhanced performance with improvements in dark count rate and near-infrared detection. By integrating the dToF system onto a single chip that encompasses drivers, microcontrollers, and ranging cores, the solution promises to minimize physical size, reduce power consumption, cut costs, and expedite the path to market deployment.

Egis, renowned for its fingerprint sensor technology, is expanding its footprint into the 3D sensing market with this partnership, following their initial collaboration with GlobalFoundries in 2022. The applications of this cutting-edge technology may include laser-assisted autofocus for smartphones and laptops, presence detection systems in smart appliances and buildings, as well as collision avoidance technology in robotics and drones.

The production capabilities for these innovative sensors are already operational at GF’s facility in Singapore, with design support provided through their GlobalShuttle program. This strategic alliance exemplifies GlobalFoundries’ commitment to enhancing its presence in the realm of intelligent sensing technologies for next-generation connected devices.

GlobalFoundries Inc. (NASDAQ:GFS) operates as a semiconductor foundry, manufacturing integrated circuits for diverse industries, including automotive, industrial, communications, and consumer electronics.

Despite the evident potential of GFS as an investment opportunity, it’s important to note that certain AI stocks are perceived to offer greater upside prospects while presenting lower downside risks. For investors seeking undervalued AI opportunities that stand to gain from Trump-era tariffs and the trend toward onshoring, we invite you to check our free report on the best short-term AI stock.

READ NEXT: Goldman Sachs Value Stocks: 10 Stocks to Buy and 14 Best Precious Metals Stocks to Buy Now.

Disclosure: None. This article was originally published at Insider Monkey.

This rewritten HTML content maintains the original structure and includes the essential details while presenting them in a unique manner suitable for a WordPress platform.